From 1 Rupee to Tanzanian Shilling: Explore the Fluctuations of Currency Exchange Rates

Step into the world of currency exchange rates, where the value of money can fluctuate dramatically. Have you ever wondered how much your 1 rupee to Tanzanian shilling is worth? This article aims to delve into the intricate realm of currency exchange rates, shedding light on the factors that influence them and the impact they have on our daily lives.

Currency exchange rates play a vital role in international trade and travel, affecting everything from the cost of imported goods to the value of your vacation money. Understanding how these rates are determined can help you make informed decisions and navigate the global financial landscape with confidence.

In this article, we will explore the dynamics behind currency exchange rates, including the role of central banks, market forces, and economic indicators. We’ll also discuss the historical trends and factors that have influenced the value of different currencies over time.

So join us on this journey as we unravel the mysteries of currency exchange rates and empower you with the knowledge you need to navigate the ever-changing financial markets.

Factors influencing currency exchange rates

In determining how much your 1 rupee to Tanzanian shilling is worth, we will need to discuss various factors that influence exchange rates. Currency exchange rates are influenced by a multitude of factors, both macroeconomic and geopolitical. Understanding these factors is crucial for predicting and comprehending currency fluctuations.

One of the primary factors is interest rates. Central banks play a significant role in determining interest rates, which can have a direct impact on the value of a currency. Higher interest rates tend to attract foreign investors seeking better returns, thereby increasing demand for the currency and driving up its value.

Another key factor is inflation. Inflation erodes the purchasing power of a currency, making it less desirable to hold. When a country experiences high inflation rates, its currency tends to depreciate in value. On the other hand, low inflation rates can make a currency more attractive to investors, leading to an increase in its value.

The overall economic health of a country also plays a crucial role in determining the value of your 1 rupee to Tanzanian shilling. Strong economic performance, characterized by high GDP growth, low unemployment rates, and stable fiscal policies, can boost the value of a currency. Conversely, economic instability or recession can lead to a depreciation in currency value.

Understanding the basics of currency exchange markets

Currency exchange rates are determined in the global foreign exchange market, where currencies are bought and sold. This market operates 24 hours a day, five days a week, and is the largest financial market in the world.

The foreign exchange market consists of various participants, including banks, corporations, governments, and individual traders. These participants engage in currency trading to facilitate international trade, hedge against currency risk, or speculate on currency movements.

Currency exchange rates are quoted in pairs, such as USD/EUR or GBP/JPY. The first currency in the pair is called the “base currency,” and the second currency is the “quote currency.” The exchange rate represents the value of the base currency in terms of the quote currency.

The foreign exchange market operates on the principles of supply and demand. When the demand for a currency exceeds its supply, its value increases. Conversely, when the supply of a currency exceeds demand, its value decreases.

Historical trends in currency exchange rates

Currency exchange rates have experienced significant fluctuations throughout history. Various events, such as wars, political instability, and economic crises, have shaped the value of currencies over time.

One notable example is the British pound sterling’s decline in the aftermath of World War II. The war heavily impacted Britain’s economy, leading to a weakened pound. Additionally, the decline of the British Empire and the rise of the United States as a global power further contributed to the pound’s depreciation.

Another significant event that impacted currency exchange rates is the 2008 global financial crisis. The crisis originated in the United States and quickly spread to other countries, causing severe economic downturns. Currencies of countries heavily affected by the crisis, such as the US dollar and the euro, experienced significant fluctuations as investors sought safe-haven assets.

The impact of currency fluctuations on international trade

Currency fluctuations have a profound impact on international trade. When a country’s currency depreciates, its exports become cheaper, making them more competitive in the global market. On the other hand, imports become more expensive, potentially leading to increased domestic production of goods.

Conversely, when a country’s currency appreciates, its exports become more expensive, potentially leading to a decrease in export volumes. Imports, on the other hand, become cheaper, providing consumers with access to a wider range of goods at lower prices.

Currency fluctuations can also impact foreign direct investment (FDI). Investors consider the potential return on investment in a particular country, taking into account currency exchange rates. A volatile currency can introduce additional risk for investors, potentially influencing their decisions.

Strategies for managing currency exchange rate risk

For businesses engaged in international trade or individuals traveling abroad, managing currency exchange rate risk is crucial. Here are some strategies commonly employed:

- Forward Contracts: Businesses can enter into forward contracts with banks or financial institutions to lock in a specific exchange rate for a future transaction. This helps mitigate the risk of adverse currency movements.

- Currency Hedging: Hedging involves taking positions in the foreign exchange market to offset potential losses from currency fluctuations. This can be done through options, futures contracts, or other derivatives.

- Diversification: Spreading risk by holding a diversified portfolio of currencies can help cushion the impact of currency fluctuations. This strategy is commonly employed by large multinational corporations.

- Monitoring Economic Indicators: Keeping track of economic indicators, such as GDP growth, inflation rates, and central bank policies, can provide insights into potential currency movements.

Tools and resources for tracking currency exchange rates

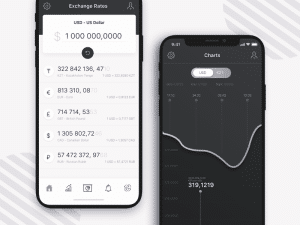

In today’s digital age, numerous tools and resources are available to track currency exchange rates. These tools can also help you easily convert your 1 rupee to Tanzanian shilling. These include:

- Currency Converter Apps: Mobile applications such as XE Currency and OANDA allow users to convert currencies and track exchange rates on the go.

- Online Currency Converters: Websites like XE.com and OANDA.com provide real-time exchange rate information and historical data.

- Financial News Websites: Websites like Bloomberg and Reuters offer comprehensive coverage of currency markets, providing insights and analysis on exchange rate movements.

- Central Bank Websites: Many central banks provide exchange rate information and economic indicators on their websites, allowing individuals and businesses to stay informed.

The role of central banks in influencing currency exchange rates

Central banks have a significant influence on currency exchange rates through their monetary policies. Key tools used by central banks include interest rate adjustments, open market operations, and foreign exchange interventions.

Interest rate adjustments can directly impact currency exchange rates. By raising or lowering interest rates, central banks can influence the attractiveness of a currency to foreign investors, thereby affecting its value.

Open market operations involve buying or selling government securities to influence the money supply and interest rates. These operations can indirectly impact currency exchange rates by influencing investor sentiment and market liquidity.

Foreign exchange interventions occur when central banks actively buy or sell their own currency in the foreign exchange market. These interventions aim to stabilize the currency’s value or counteract excessive volatility.

Case studies of significant currency exchange rate fluctuations

Throughout history, several countries have experienced significant currency exchange rate fluctuations with far-reaching consequences. Here are two notable case studies:

- The Asian Financial Crisis (1997-1998): The crisis originated in Thailand and quickly spread to other Asian countries. Currencies, such as the Thai baht, Indonesian rupiah, and South Korean won, depreciated sharply, leading to severe economic contractions and financial instability.

- The Swiss Franc Appreciation (2015): The Swiss National Bank surprised markets by removing the cap on the Swiss franc’s value against the euro. This led to a sudden appreciation of the Swiss franc, causing significant losses for businesses and investors who had positions denominated in Swiss francs.

Implications for individuals and businesses

Currency exchange rates are a crucial aspect of the global financial system, impacting individuals and businesses alike. The fluctuations in exchange rates can have far-reaching implications for international trade, investments, and purchasing power.

Understanding the factors that influence currency exchange rates and the strategies for managing currency risk can help individuals and businesses make informed decisions about converting your 1 rupee to Tanzanian shilling. Additionally, staying informed through the use of tools and resources can provide valuable insights into currency market trends.

By navigating the ever-changing world of currency exchange rates, individuals and businesses can protect themselves from potential risks and seize opportunities in the global marketplace. So, whether you’re planning a trip abroad or conducting international business, understanding currency exchange rates is essential for success.

For more articles related to Financial Services in Tanzania, click here!