Breaking Down the Battle of Currencies: Kenya’s Shilling vs Tanzania’s Shilling

Are you curious about the ongoing battle of currencies in East Africa? In this article, we will delve into the fascinating world of the Kenya vs Tanzania currency, analyzing their differences and similarities. Both currencies play a crucial role in their respective economies, but how do they stack up against each other?

With the surge in globalization and cross-border trade, understanding currency dynamics has become increasingly important. Kenya’s Shilling is the official currency of Kenya, while Tanzania’s Shilling serves as the national currency in Tanzania. While both currencies are part of the East African Community, they differ in terms of their value, exchange rates, and their impact on the economies of their respective countries.

Join us as we explore the historical background, economic factors, and key considerations of the Kenya vs Tanzania currency. Whether you’re a business owner, a traveler, or simply interested in economics, this article will provide valuable insights into the battle of currencies between Kenya’s Shilling and Tanzania’s Shilling.

History and background of the Kenyan shilling

The Kenyan shilling has a rich history that dates back to the pre-colonial era. It was introduced as the official currency of Kenya in 1966, replacing the East African shilling. The move was aimed at establishing a national identity and fostering economic independence.

Since then, the Kenya vs Tanzania currency has experienced various ups and downs, influenced by both internal and external factors. In the 1990s, the country underwent significant economic reforms, leading to the liberalization of the foreign exchange market. This allowed the shilling to float freely against other major currencies, leading to increased volatility.

Today, the Kenyan shilling remains a stable currency, supported by a strong agricultural sector, a growing tourism industry, and a vibrant service sector. The Central Bank of Kenya plays a crucial role in maintaining the stability of the currency through monetary policy interventions.

History and background of the Tanzanian shilling

When comparing the Kenya vs Tanzania currency, it’s necessary to also look at the history of the Tanzanian shilling. The Tanzanian shilling, like its Kenyan counterpart, has a long history that can be traced back to the pre-colonial period. It became the official currency of Tanzania in 1966, replacing the East African shilling.

Tanzania has experienced its fair share of economic challenges over the years, including periods of high inflation and currency devaluation. These difficulties were often a result of external factors such as global economic shocks and internal factors like mismanagement of the economy.

However, in the ongoing Kenya vs Tanzania currency comparison, it should be noted that in recent years, Tanzania has made significant strides in stabilizing its currency and boosting its economy. The government has implemented various reforms to attract foreign investment and promote economic growth. This has led to increased confidence in the Tanzanian shilling and its value in international markets.

Factors influencing the value of the Kenyan shilling

Several factors influence the value of the Kenyan shilling. One of the primary factors is the country’s balance of trade. Kenya heavily relies on imports, especially for essential goods and services. When the country’s imports exceed its exports, it puts pressure on the shilling, leading to depreciation.

Another significant factor influencing the value of the shilling that must be considered in this ongoing Kenya vs Tanzania currency assessment is foreign direct investment (FDI). Kenya has attracted substantial FDI in recent years, especially in sectors such as manufacturing, real estate, and technology. Increased FDI inflows strengthen the shilling as it reflects investor confidence in the country’s economy.

Additionally, political stability, inflation rates, and interest rates play a crucial role in determining the value of the Kenyan shilling. A stable political environment and low inflation rates generally contribute to a stronger currency. Conversely, high inflation and unstable political conditions can weaken the shilling.

Factors influencing the value of the Tanzanian shilling

When looking at the Kenya vs Tanzania currency, it’s clear that the value of the Tanzanian shilling is also influenced by various factors. One of the key drivers is the country’s trade balance. Tanzania heavily relies on agricultural commodities, such as coffee, tea, and tobacco, for its exports. Fluctuations in global commodity prices can impact the value of the shilling.

Foreign investment also plays a significant role in determining the value of the Tanzanian shilling. The government has implemented policies to attract FDI, particularly in sectors such as mining, energy, and tourism. Increased foreign investment strengthens the currency and contributes to economic growth.

Moreover, inflation rates and interest rates impact the value of the Kenya vs Tanzania currency. High inflation erodes the purchasing power of the currency, leading to depreciation. On the other hand, lower inflation rates and attractive interest rates can boost the value of the shilling.

A comparison of the exchange rates between the two currencies

The exchange rates between the Kenyan shilling and the Tanzanian shilling are determined by various factors, including market forces, economic conditions, and government policies. Historically, the Kenyan shilling has been stronger than the Tanzanian shilling, reflecting Kenya’s relatively larger economy and higher levels of foreign investment.

However, exchange rates can fluctuate over time due to changes in economic conditions. It is essential to monitor the rates of the Kenya vs Tanzania currency regularly and consider factors such as inflation, interest rates, and political stability when exchanging currencies.

Economic impact of the currencies on their respective countries

Both the Kenyan shilling and the Tanzanian shilling play crucial roles in their respective economies. The stability and strength of these currencies have a direct impact on various sectors, including trade, tourism, and investment.

A Kenya vs Tanzania currency can boost imports by making foreign goods and services more affordable. It can also attract foreign investors, as a stable currency reduces the risk of currency depreciation. Conversely, a weak currency can benefit exporters by making their goods and services more competitive in international markets.

The Kenyan shilling’s stability has contributed to Kenya’s position as a regional economic hub. It has attracted significant foreign investment, promoted trade, and supported economic growth. The Tanzanian shilling, although historically weaker, has gained stability in recent years, leading to increased investor confidence and economic development.

Investing in the Kenyan shilling vs Tanzanian shilling

Investing in the Kenya vs Tanzania currency can be an attractive option for those looking to diversify their investment portfolio. However, it is important to consider various factors before making any investment decisions.

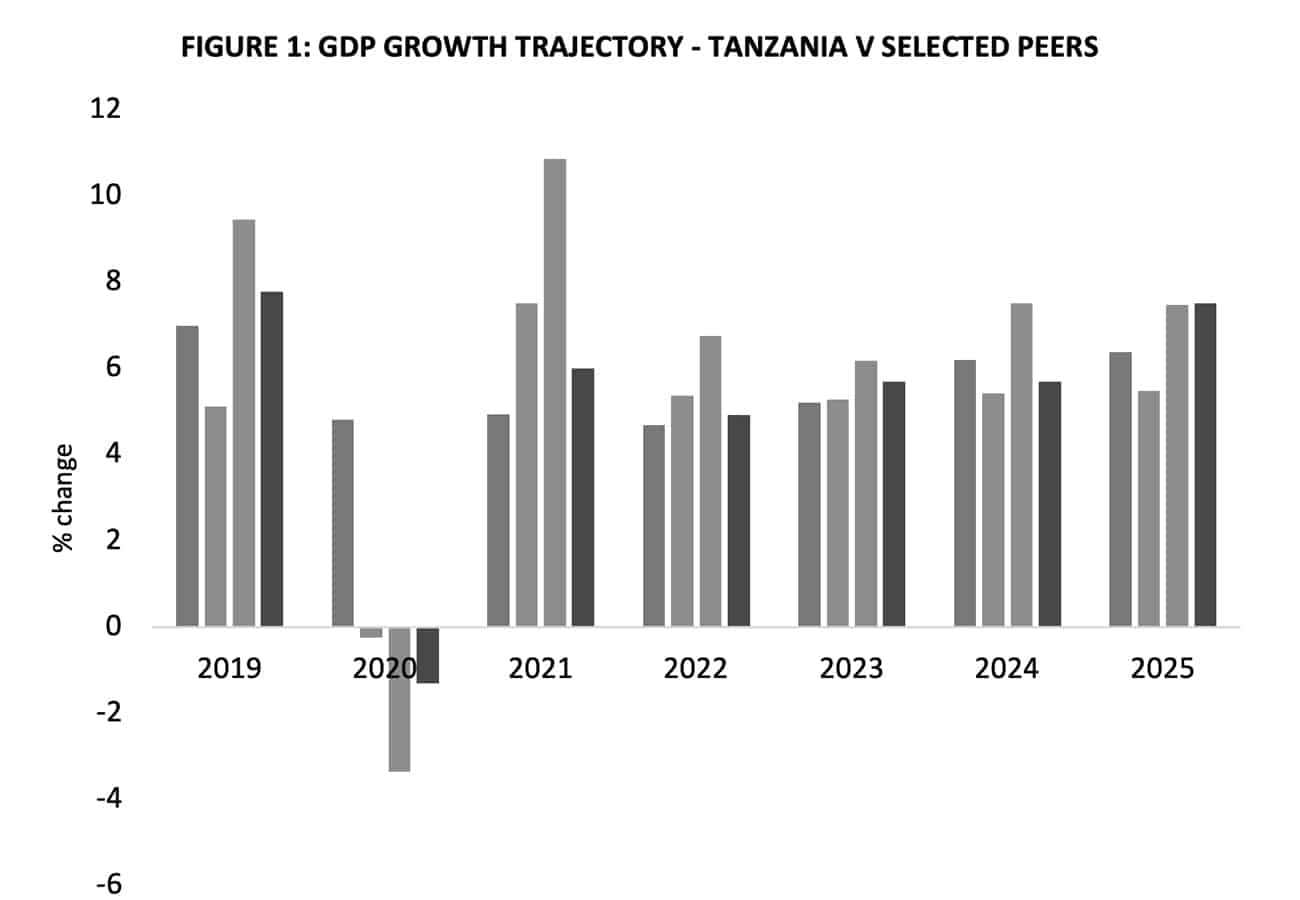

One factor to consider is the economic outlook of each country. Analyzing economic indicators such as GDP growth, inflation rates, and political stability can provide valuable insights into the potential return on investment.

Another factor to consider when looking to invest in the Kenya vs Tanzania currency is the exchange rate between the two currencies. While the Kenyan shilling has historically been stronger, exchange rates can fluctuate, presenting opportunities for investors.

Additionally, it is essential to understand the regulatory environment and any restrictions on foreign investment in each country. Consulting with a financial advisor or conducting thorough research can help investors make informed decisions.

Tips for travelers: Using the currencies in Kenya and Tanzania

If you are planning to travel to Kenya or Tanzania, it is essential to familiarize yourself with the Kenya vs Tanzania currency and their usage. Both countries primarily use cash for everyday transactions, although electronic payment methods are becoming increasingly popular in urban areas.

It is advisable to carry a mix of cash and cards, including international credit or debit cards, for convenience and security. It is also essential to exchange currency at authorized banks or foreign exchange bureaus to avoid counterfeit notes.

Furthermore, it is essential to keep an eye on the exchange rates of the Kenya vs Tanzania currency and monitor any changes before and during your trip. This will help you make informed decisions when exchanging currencies and budgeting for your expenses.

Which shilling comes out on top?

In the battle of currencies between Kenya’s Shilling and Tanzania’s Shilling, it is challenging to determine a clear winner. Both currencies have their strengths and weaknesses, influenced by various economic factors.

The highlights of the Kenya vs Tanzania currency being that the Kenyan shilling has been historically known for its stability and strong economic fundamentals. It has also attracted significant foreign investment and played a vital role in Kenya’s economic growth. On the other hand, the Tanzanian shilling has made impressive strides in recent years, improving its stability and gaining investor confidence.

Ultimately, the value and performance of each currency depend on a range of factors, including economic conditions, political stability, and global market dynamics. As investors, travelers, or individuals interested in economics, it is important to stay informed and consider these factors when evaluating the battle of currencies between Kenya’s Shilling and Tanzania’s Shilling. Only then can we truly understand the fascinating world of East African currencies and their impact on the region’s economies.

For more articles related to Financial Services in Tanzania, click here!