Inflation Rate in Tanzania 2015 to 2020: Trends, Factors, and Implications for the Economy

Introduction to the inflation rate in Tanzania

Inflation is an essential economic indicator that measures the rate at which the general level of prices for goods and services is rising and subsequently eroding purchasing power. In Tanzania, the inflation rate has been a topic of concern for policymakers and citizens alike. This article aims to provide an in-depth analysis of the inflation rate in Tanzania 2015 to 2020, exploring the factors influencing it, its trends, and the implications it has on the economy.

Understanding inflation and its impact on the economy

Before delving into the specifics of the inflation rate in Tanzania 2015 to 2020, it is crucial to understand the concept of inflation and its impact on the economy. Inflation can be caused by various factors, such as increases in the cost of production, changes in government policies, or fluctuations in demand and supply. When the inflation rate is high, the purchasing power of the currency decreases, leading to a rise in the overall cost of living. This can have severe consequences for individuals and businesses, including reduced savings, decreased investment, and uncertainty in long-term planning.

Factors influencing the inflation rate in Tanzania

Several factors contribute to the inflation rate in Tanzania 2015 to 2020. One of the primary drivers is the cost of production, including wages, raw materials, and transportation. When these costs increase, businesses often pass them on to consumers through higher prices, resulting in inflation. Government policies, such as changes in taxation or monetary policies, can also impact inflation. Additionally, fluctuations in international commodity prices, particularly for essential goods like oil, can have a significant influence on Tanzania’s inflation rate.

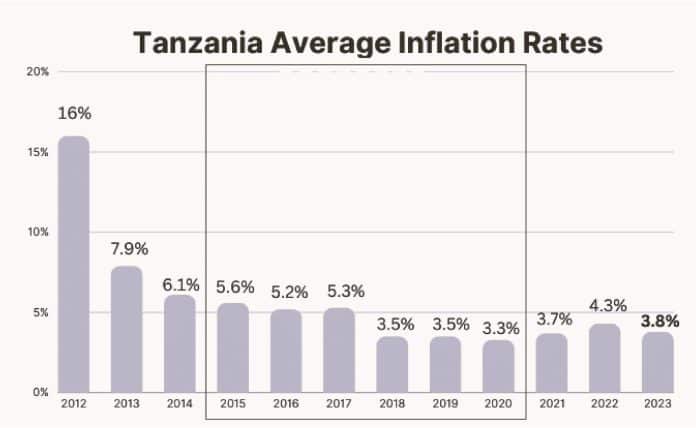

Inflation rate trends in Tanzania from 2015 to 2020

Analyzing the inflation rate trends in Tanzania from 2015 to 2020 provides valuable insights into the country’s economic performance. In 2015, Tanzania experienced an inflation rate of 6.1%, which steadily increased to 7.0% in 2016. The following years saw a slight decrease, with the inflation rate reaching 5.2% in 2017 and 3.5% in 2018. However, in 2019, the inflation rate rose again to 3.8%, followed by a significant increase to 5.4% in 2020. These trends indicate some volatility in Tanzania’s inflation rate, reflecting the impact of various economic factors.

Implications of high inflation on the economy

High inflation can have adverse effects on Tanzania’s economy. Firstly, it erodes the purchasing power of consumers, making it more challenging for individuals and households to afford essential goods and services. This can lead to a decline in living standards and increased poverty levels. Secondly, high inflation can disrupt business operations, as companies struggle to adjust their prices and manage costs effectively. Uncertainty caused by inflation can discourage investment and hinder economic growth. Lastly, inflation can lead to an increase in interest rates, making it more expensive for businesses and individuals to borrow money for investment or consumption purposes.

Government measures to control inflation

To mitigate the negative effects of inflation, the Tanzanian government has implemented measures to control the inflation rate. These measures include monetary policies aimed at controlling the money supply in the economy, such as adjusting interest rates and reserve requirements for banks. Additionally, the government has focused on fiscal policies to manage inflation, such as controlling government spending and implementing tax reforms. These measures aim to stabilize prices, encourage investment, and promote economic growth while ensuring that inflation remains within a manageable range.

Expert opinions on the inflation rate in Tanzania

Economists and experts have varying opinions on the inflation rate in Tanzania. Some argue that the government’s measures have been effective in controlling inflation and stabilizing the economy. They highlight the declining trend in the inflation rate in Tanzania 2015 to 2020 as evidence of successful policy implementation. However, others express concerns about the recent increase in inflation, suggesting that further actions may be necessary to address the underlying causes. These differing opinions highlight the complexity of managing inflation and the need for ongoing evaluation and adjustment of policies.

Comparing Tanzania’s inflation rate with other countries in the region

When analyzing the inflation rate in Tanzania, it is essential to compare it with other countries in the region. Tanzania’s inflation rate has generally been lower than that of its neighboring countries, such as Kenya and Uganda. This can be attributed to various factors, including Tanzania’s stable political environment, robust agricultural sector, and prudent economic policies. However, it is crucial to note that inflation rates can fluctuate due to unique economic circumstances in each country, making direct comparisons challenging.

Strategies to protect your finances against inflation

Inflation can significantly impact individual finances. To protect against its effects, there are several strategies individuals can employ. Firstly, investing in assets that appreciate in value over time, such as real estate or stocks, can provide a hedge against inflation. Secondly, diversifying investments across different asset classes and regions can help mitigate risk and preserve wealth. Additionally, considering inflation-protected securities, such as government bonds or inflation-indexed funds, can provide some security. Finally, regularly reviewing and adjusting personal budgets and savings plans can help individuals adapt to changing economic conditions and maintain financial stability.

Future outlook for the inflation rate in Tanzania

As Tanzania continues to develop and its economy evolves, the inflation rate will remain a crucial indicator of economic health. While the recent increase in inflation is a cause for concern, the government’s measures to control inflation and stabilize the economy have shown some positive results in the past. However, ongoing monitoring and evaluation of policies will be necessary to ensure that inflation remains within an acceptable range. By understanding the factors that influenced the inflation rate in Tanzania 2015 to 2020, individuals and businesses can make informed financial decisions to protect their interests and contribute to Tanzania’s economic stability and growth.

For more articles related to Financial Services in Tanzania, click here!