Navigating the Currency Market: Discovering the Best Forex Brokers in Tanzania

Are you a Tanzanian trader looking to explore the world of forex trading? The currency market can be a complex and unpredictable landscape, but with the right broker by your side, you can navigate it successfully. In this article, we will introduce you to some of the best forex brokers in Tanzania, helping you make an informed decision and maximize your trading potential.

Understanding the role of forex brokers

Forex brokers play a crucial role in facilitating currency trading for individuals and institutions. They serve as intermediaries between traders and the global currency market, providing access to various currency pairs and financial instruments. Forex brokers offer trading platforms that allow traders to execute buy and sell orders, access real-time market data, and manage their trading accounts.

One of the primary responsibilities of a forex broker is to provide liquidity to traders. Liquidity refers to the ability to buy and sell currencies without causing significant price fluctuations. Brokers achieve this by connecting their clients to a network of liquidity providers, including banks, financial institutions, and other traders. Additionally, brokers offer leverage, which allows traders to control larger positions with a smaller amount of capital.

It is important to understand that forex brokers operate in a highly competitive industry, and not all brokers are created equal. Choosing the right broker is crucial to your success as a forex trader. Let’s explore the key factors you should consider when looking for the best forex brokers in Tanzania.

Key factors to consider when choosing a forex broker in Tanzania

- Regulatory compliance: The first and foremost factor to consider when choosing a forex broker is regulatory compliance. A regulated broker ensures that your funds are safe and that you are trading in a fair and transparent environment. In Tanzania, the Capital Markets and Securities Authority (CMSA) is the regulatory body responsible for overseeing the activities of forex brokers. Make sure the broker you choose is licensed and regulated by the CMSA or a reputable international regulatory authority.

- Trading platforms: The trading platorm is the software provided by the broker for executing trades and accessing market data. It is essential to choose a broker that offers a reliable and user-friendly trading platform. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their advanced charting capabilities and algorithmic trading features. Look for brokers that offer a range of trading platforms and ensure they are compatible with your device and operating system.

- Trading instruments: The variety of trading instruments offered by a broker is another important consideration. While forex trading involves buying and selling currencies, many brokers also offer other financial instruments such as commodities, indices, and cryptocurrencies. Having access to a diverse range of instruments allows you to diversify your trading portfolio and take advantage of different market opportunities. Consider your trading preferences and choose a broker that offers the instruments you are interested in trading.

Now that we have discussed the key factors to consider, let’s delve into the regulations and licensing requirements for forex brokers in Tanzania.

Regulations and licensing for forex brokers in Tanzania

The forex market in Tanzania is regulated by the Capital Markets and Securities Authority (CMSA). The CMSA is responsible for licensing and overseeing the activities of forex brokers operating in the country. The regulatory framework aims to protect investors and ensure the integrity of the financial markets.

To operate legally in Tanzania, forex brokers must obtain a license from the CMSA. The licensing process involves rigorous scrutiny of the broker’s financial stability, operational procedures, and adherence to regulatory requirements. Licensed brokers are required to meet certain capital adequacy requirements and maintain segregated client accounts to safeguard client funds.

When choosing a forex broker in Tanzania, it is crucial to verify their regulatory status. Look for brokers that display their license information prominently on their website. Additionally, you can check the CMSA’s official website to confirm the broker’s licensing status and any disciplinary actions taken against them.

Now that we have covered the regulatory aspect, let’s explore some of the best forex brokers in Tanzania and the features they offer.

Top forex brokers in Tanzania and their features

- Broker A: Broker A is a licensed forex broker regulated by the CMSA. They offer a user-friendly trading platform compatible with both desktop and mobile devices. The platform provides access to a wide range of currency pairs, commodities, and indices. Broker A offers competitive spreads and low commissions, making it an attractive choice for cost-conscious traders. They also provide a comprehensive educational section with tutorials, webinars, and market analysis.

- Broker B: Broker B is an internationally regulated broker with a strong presence in Tanzania. They offer multiple trading platforms, including MT4 and MT5, along with a proprietary platform for advanced traders. Broker B provides tight spreads, fast execution, and a wide range of trading instruments. They have a dedicated customer support team available 24/7, ensuring prompt assistance for any trading-related queries.

- Broker C: Broker C is a well-established broker known for its cutting-edge trading technology. They offer a proprietary platform with advanced charting tools and customizable indicators. Broker C provides competitive spreads and low trading fees. They also offer a social trading feature, allowing traders to follow and copy the trades of successful traders in real-time.

Now that we have explored some of the top forex brokers in Tanzania, let’s compare the spreads, commissions, and fees offered by these brokers.

Comparing spreads, commissions, and fees

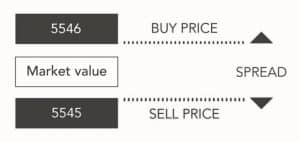

Spreads, commissions, and fees can significantly impact your trading performance and profitability. It is important to compare these factors when choosing a forex broker in Tanzania.

Broker A offers competitive spreads starting from 0.5 pips and charges a small commission per trade. They have transparent fee structures and no hidden charges. Broker B also offers tight spreads, starting from 0.3 pips, and charges a small commission per lot traded. They provide a detailed breakdown of their fees on their website.

Broker C has variable spreads, starting from 1 pip, and does not charge any commission. However, it is important to note that brokers with no commission may have wider spreads, which can affect your overall trading costs. Consider your trading style and preferences when comparing spreads, commissions, and fees.

Apart from the cost-related factors, evaluating the trading platforms and tools offered by forex brokers is crucial. Let’s explore this aspect in detail.

Evaluating trading platforms and tools offered by forex brokers

The trading platform is your gateway to the forex market, and it is essential to choose a broker that offers a reliable and feature-rich platform. Most brokers offer popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their user-friendly interface and advanced charting capabilities.

In addition to the trading platform, consider the availability of trading tools and features offered by the broker. These may include:

- Technical analysis tools: Look for brokers that provide a wide range of technical indicators, drawing tools, and charting options. These tools can help you analyze the market and make informed trading decisions.

- Algorithmic trading: If you are interested in automated trading, ensure that the broker supports algorithmic trading through expert advisors (EAs) or automated trading systems. This allows you to execute trades based on predefined rules and strategies.

- Educational resources: Consider brokers that offer educational resources such as tutorials, webinars, and trading guides. These resources can help you enhance your trading skills and stay updated with market trends.

Now that we have discussed the trading platforms and tools, let’s shift our focus to customer support and reputation.

Researching customer support and reputation

Customer support is a crucial aspect of any forex broker. It is essential to choose the best forex brokers in Tanzania that provides responsive and reliable customer support, especially during critical trading hours. Look for brokers that offer multiple channels of communication, including live chat, email, and phone support.

Additionally, consider the broker’s reputation in the industry. Read reviews and testimonials from other traders to get an idea of their experiences with the broker. Look for brokers with a positive reputation for prompt customer support, transparent trading conditions, and reliable order execution.

Now that you have a clear understanding of the key factors to consider when choosing a forex broker in Tanzania, let’s explore the process of opening a forex trading account.

Opening a forex trading account with a broker in Tanzania

Opening a forex trading account with a broker in Tanzania is a straightforward process. Follow these steps to get started:

- Research and shortlist: Based on your preferences and requirements, research and shortlist a few brokers that align with your trading goals.

- Account registration: Visit the broker’s website and navigate to the account registration page. Fill in the required information, including personal details and financial information. Ensure that the information provided is accurate and up to date.

- Account verification: Most regulated brokers require you to verify your identity and address. This is done to comply with anti-money laundering (AML) regulations. Provide the necessary documents, such as a valid ID and proof of address, to complete the verification process.

- Funding your account: Once your account is verified, you can fund it using various payment methods offered by the broker. These may include bank transfers, credit/debit cards, or e-wallets. Choose the method that is most convenient for you and follow the instructions provided by the broker.

- Start trading: Once your account is funded, you can start trading. Familiarize yourself with the trading platform and explore the available trading instruments. Consider using demo accounts to practice your trading strategies before risking real money.

Finding the best forex broker in Tanzania for your trading needs

Navigating the currency market requires the right forex broker by your side. By considering factors such as regulatory compliance, trading platforms, customer support, and available trading instruments, you can make an informed decision and choose the best forex brokers in Tanzania for your trading needs.

Remember to compare spreads, commissions, and fees to ensure they align with your trading style and budget. Evaluate the trading platforms and tools offered by brokers to find one that meets your requirements. Research customer support and reputation to ensure you have a reliable and responsive broker.

With the help of the best forex brokers in Tanzania, you can gain access to competitive spreads, advanced trading tools, and educational resources to enhance your trading skills. Get ready to dive into the exciting world of forex trading and maximize your trading potential!

For more articles related to Financial Services in Tanzania, click here!