Revolutionizing Banking in Tanzania: Exploring the Services and Innovations of United Bank for Africa

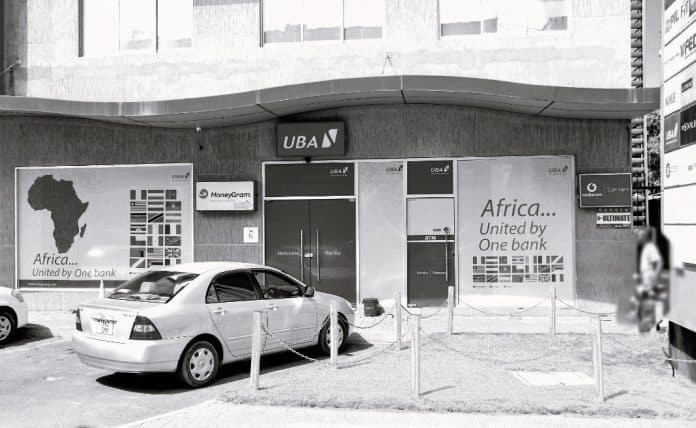

In the rapidly evolving landscape of the Tanzanian banking sector, one institution that is making waves with its innovative services and customer-centric approach is the United Bank for Africa Tanzania. With a strong focus on revolutionizing banking in the country, UBA has reimagined traditional banking practices to provide an unmatched experience to its customers.

As more people in Tanzania turn to digital banking, UBA has successfully capitalized on this trend by offering a comprehensive suite of online and mobile banking services. From seamless fund transfers to convenient bill payment options, UBA’s digital platforms provide customers with the flexibility and convenience they need in today’s fast-paced world.

What sets the United Bank of Africa Tanzania apart is not just its cutting-edge technology but also its commitment to financial inclusion. The bank has launched innovative initiatives, such as its agency banking network, which brings banking services closer to underserved communities. By partnering with local businesses and individuals, UBA is ensuring that even those in remote areas have access to quality banking services.

With its forward-thinking approach and dedication to customer satisfaction, UBA is leading the way in revolutionizing the banking industry in Tanzania. Whether you’re a tech-savvy individual or someone who prefers the personal touch of a traditional bank, UBA has something for everyone. Discover the future of banking with United Bank for Africa Tanzania.

Overview of the banking industry in Tanzania

The banking industry in Tanzania has undergone significant changes in recent years, driven by advancements in technology and changing customer preferences. With a population of over 60 million people, Tanzania presents a vast market for banking institutions to tap into. However, traditional banking practices have often failed to meet the evolving needs of the population, leading to a growing demand for more innovative and customer-centric banking solutions.

UBA recognized this need for change and has positioned itself as a pioneer in revolutionizing the banking industry in Tanzania. The bank has taken a proactive approach to adapt to the changing landscape, investing in advanced technology and offering a wide range of services tailored to the needs of the Tanzanian market.

Services offered by UBA in Tanzania

UBA offers a comprehensive suite of banking services designed to cater to the diverse needs of its customers in Tanzania. Whether you’re an individual looking for a reliable banking partner or a business seeking efficient financial solutions, UBA has you covered.

One of the key services offered by United Bank of Africa Tanzania is its online and mobile banking platform. With the UBA mobile app, customers can conveniently access their accounts, transfer funds, pay bills, and even apply for loans, all from the comfort of their smartphones. This digital platform has revolutionized the way people bank in Tanzania, providing them with the flexibility and convenience they need in today’s fast-paced world.

In addition to digital banking, UBA also offers traditional banking services through its extensive branch network. With branches strategically located across the country, customers can easily access services such as account opening, cash deposits, withdrawals, and personalized financial advice. UBA’s commitment to providing a seamless banking experience extends to its physical branches, where customers can expect efficient service and a welcoming atmosphere.

Innovative digital banking solutions by UBA

UBA’s commitment to revolutionizing banking in Tanzania is evident in its innovative digital banking solutions. The bank has embraced technology to create a seamless and secure banking experience for its customers.

One of the standout features of UBA’s digital banking platform is its seamless fund transfer service. Customers can transfer funds to other UBA accounts or to accounts in other banks within Tanzania with just a few clicks. The process is fast, secure, and eliminates the need for time-consuming paperwork or visits to the bank.

The United Bank for Africa Tanzania has also introduced convenient bill payment options through its digital platforms. Customers can easily settle their utility bills, such as electricity and water, without the hassle of queuing or visiting multiple payment centers. This feature has been particularly well-received by customers, saving them time and ensuring that their bills are paid on time.

Another innovative offering by UBA is its virtual card service. Customers can generate virtual cards through the UBA mobile app, which can be used for online purchases. This provides an added layer of security for customers, as the virtual cards are not linked to their physical debit cards. It also gives customers more control over their spending, as they can set limits for each virtual card.

UBA’s digital banking solutions have not only simplified banking for customers but have also contributed to financial inclusion in Tanzania. The ease of access and user-friendly interfaces of UBA’s digital platforms have made banking more accessible to individuals who may not have had access to traditional banking services before.

UBA’s commitment to financial inclusivity in Tanzania

Financial inclusion is a key focus for the United Bank of Africa Tanzania. The bank recognizes the importance of providing banking services to all segments of society, including those in underserved communities. To achieve this, UBA has launched an extensive agency banking network throughout the country.

The agency banking network allows individuals and small businesses in remote areas to offer basic banking services on behalf of UBA. These agents, who are typically local business owners or community leaders, act as an extension of UBA’s physical branches, providing services such as account opening, cash deposits, withdrawals, and bill payments.

By partnering with local businesses and individuals, UBA is not only bringing banking services closer to underserved communities but also creating economic opportunities for these agents. The agency banking network has empowered individuals to become entrepreneurs and generate income while providing essential banking services to their communities.

UBA’s commitment to financial inclusivity extends beyond its agency banking network. The bank also offers tailored financial products and services to cater to the needs of low-income individuals and small businesses. This includes microfinance loans, savings accounts with low minimum balance requirements, and financial literacy programs to empower individuals with the necessary knowledge to make informed financial decisions.

UBA’s contribution to the growth of the Tanzanian economy

UBA’s innovative services and commitment to financial inclusion have not only transformed the banking industry in Tanzania but have also contributed to the overall growth of the country’s economy. By providing efficient banking solutions to individuals and businesses, UBA has played a crucial role in facilitating economic activities and driving financial inclusion.

Small and medium-sized enterprises (SMEs) form the backbone of Tanzania’s economy, and UBA has recognized the importance of supporting these businesses. The bank offers a range of financial products and services specifically designed for SMEs, including working capital loans, trade finance facilities, and business advisory services. By providing SMEs with access to affordable financing and the necessary tools to grow their businesses, UBA has played a significant role in fueling economic growth and job creation in Tanzania.

UBA’s commitment to supporting economic growth extends to its corporate social responsibility initiatives. The bank has implemented various programs aimed at empowering communities and promoting sustainable development. These initiatives include educational scholarships, healthcare support, and environmental conservation projects. By investing in the social and economic development of Tanzania, UBA is not only fulfilling its corporate social responsibility but also fostering a positive impact on the country’s overall development.

Customer testimonials and success stories with UBA in Tanzania

UBA’s customer-centric approach and innovative services have garnered praise from customers across Tanzania. Numerous testimonials and success stories highlight the positive experiences customers have had with UBA.

One customer, Sarah Mwita, shared her experience with UBA’s digital banking platform, stating, “I used to spend hours standing in long queues at the bank, but ever since I started using UBA’s mobile app, my banking experience has been transformed. I can now transfer funds, pay bills, and even apply for loans with just a few taps on my phone. It’s so convenient!”

Another customer, John Kijana, expressed his gratitude for UBA’s agency banking network, saying, “I live in a remote village, and there are no banks nearby. Thanks to UBA’s agency banking, I can now deposit and withdraw cash without traveling long distances. The agent in my village is friendly and always ready to assist. It has made my life so much easier.

These testimonials and success stories reflect the positive impact UBA has had on the lives of its customers in Tanzania. By understanding their needs and providing innovative solutions, UBA has earned the trust and loyalty of its customers, setting itself apart from other banking institutions in the country.

UBA’s future plans and expansion strategies in Tanzania

UBA’s success in revolutionizing banking in Tanzania has positioned the bank for further growth and expansion in the country. The bank has ambitious plans to continue investing in technology and expanding its service offerings to meet the evolving needs of its customers.

One of UBA’s key focus areas for the future is enhancing its digital banking capabilities. The bank aims to further streamline its online and mobile banking platforms, introducing new features and functionalities to provide an even better user experience. UBA is also exploring opportunities to leverage emerging technologies such as artificial intelligence and blockchain to enhance its banking services.

In terms of physical expansion, the United Bank for Africa Tanzania plans to increase its branch network across Tanzania. By strategically locating branches in underserved areas, the bank aims to bring banking services closer to individuals and businesses who may not have easy access to financial institutions. This expansion will further strengthen UBA’s commitment to financial inclusion and support the economic growth of Tanzania.

UBA also plans to expand its corporate social responsibility initiatives, focusing on areas such as education, healthcare, and environmental conservation. By partnering with organizations and communities, UBA aims to make a lasting impact on the social and economic development of Tanzania.

The United Bank of Africa Tanzania is at the forefront of revolutionizing the banking industry in Tanzania. With its innovative services and customer-centric approach, UBA has reimagined traditional banking practices to cater to the evolving needs of its customers. From its comprehensive suite of digital banking solutions to its commitment to financial inclusion and corporate social responsibility, UBA has set itself apart as a leader in the Tanzanian banking sector.

As more people in Tanzania embrace digital banking, UBA’s cutting-edge technology and commitment to customer satisfaction make it an ideal banking partner. Whether you prefer the convenience of online and mobile banking or the personal touch of a physical branch, UBA has something for everyone. By continuously investing in technology, expanding its service offerings, and supporting the growth of Tanzania’s economy, UBA is shaping the future of banking in the country. Discover the future of banking with United Bank for Africa and experience the revolution firsthand.

For more articles related to Financial Services in Tanzania, click here!