Simplifying International Transactions: Bank of Africa Tanzania Swift Code Explained

In this modern era of globalization, conducting international transactions has become a common practice. However, navigating through the complexities of global finance can be quite daunting, especially when it comes to sending or receiving money across borders. Luckily, Bank of Africa Tanzania is here to simplify the process for its customers. One essential tool that ensures seamless international transfers is the Swift Code.

In this article, we will delve deeper into the Bank of Africa Tanzania Swift Code and explain its significance in facilitating international transactions. Whether you’re a Tanzanian resident looking to send money abroad or an expatriate living in Tanzania needing to receive funds from overseas, understanding the Swift Code is essential.

We will break down the structure of the Swift Code, its purpose, and how to find it for Bank of Africa Tanzania. By the end of this article, you will have a clear understanding of how to use the Swift Code efficiently and effectively for all your international banking needs. Say goodbye to the complexities of international transactions and hello to simplified banking with Bank of Africa Tanzania’s Swift Code.

What is a swift code and how does it work?

A Swift Code, also known as a Bank Identifier Code (BIC), is a unique identification code used to identify specific banks or financial institutions worldwide. It is an internationally recognized standard for identifying banks and ensures secure and efficient communication between financial institutions during international transactions.

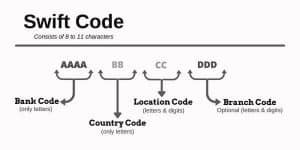

The Swift Code consists of a combination of letters and numbers, with each section providing specific information about the bank and its location. The code is divided into four parts: the Bank Code, Country Code, Location Code, and Branch Code. These sections work together to identify the precise bank and branch involved in the transaction.

When initiating an international transaction, the sender’s bank uses the Swift Code to ensure the funds are routed correctly to the recipient’s bank. The Swift Code acts as a digital address, allowing the banks to communicate with each other and facilitate the transfer securely and accurately. It is important to note that the Swift Code is not the same as an IBAN (International Bank Account Number), which identifies an individual’s bank account.

Understanding the structure of a Bank of Africa Tanzania swift code

To understand the structure of a Bank of Africa Tanzania Swift Code, let’s break it down section by section. Here is an example Swift Code for Bank of Africa Tanzania: “AFRI TZ TW XXX”.

The first four letters, “AFRI,” represent the Bank Code, which identifies Bank of Africa as the specific financial institution involved in the transaction. This code is unique to Bank of Africa and distinguishes it from other banks.

The next two letters, “TZ,” represent the Country Code, which identifies Tanzania as the country where Bank of Africa is located. Each country has its own unique Country Code within the Swift system.

The following two letters, “TW,” represent the Location Code, which identifies the specific location of Bank of Africa within Tanzania. This code helps narrow down the search to the correct bank branch.

The last three letters, “XXX,” represent the Branch Code. In this case, “XXX” is a placeholder, indicating that there is no specific branch code provided. If there were multiple branches of Bank of Africa in Tanzania, each branch would have its own unique three-letter code.

By understanding the structure of the Swift Code, you can easily identify the specific bank and branch involved in the international transaction. This ensures accurate and efficient processing of funds.

How to find the Bank of Africa Tanzania swift code

Finding the Bank of Africa Tanzania Swift Code is a straightforward process. There are a few different methods you can use:

- Bank Website: The easiest and most reliable method is to visit the Bank of Africa Tanzania website. Look for the “Contact” or “Branches” section, where you will likely find the Swift Code listed along with other important contact information. The website will also provide any updates or changes to the Swift Code, ensuring you have the most accurate information.

- Swift Code Search Engines: There are several online platforms that specialize in providing Swift Codes for various banks worldwide. Simply enter “Bank of Africa Tanzania” or “Bank of Africa Tanzania Swift Code” into the search bar, and you will be presented with the relevant information. It is important to cross-reference the information obtained from search engines with the official bank website to ensure accuracy.

- Contact the Bank: If you are unable to find the Swift Code using the above methods, you can contact Bank of Africa Tanzania directly. Reach out to their customer support or visit a local branch to inquire about the Swift Code. The bank staff will be able to provide you with the accurate code and answer any additional questions you may have.

It is important to always double-check the Swift Code to avoid any errors or delays in your international transactions. Using outdated or incorrect codes can result in funds being sent to the wrong bank or branch, causing unnecessary complications.

Swift code alternatives for international transactions in Tanzania

While the Swift Code is the most commonly used method for international transactions in Tanzania, there are alternative options available. These alternatives may be useful in certain situations or for specific types of transactions.

- IBAN: As mentioned earlier, the IBAN (International Bank Account Number) is another widely used method for identifying bank accounts during international transactions. While the IBAN is not specific to Tanzania, it is recognized internationally and can be used instead of or in conjunction with the Swift Code. The IBAN provides additional information about the recipient’s bank account, ensuring accurate routing of funds.

- Local Payment Systems: Some countries have their own local payment systems that are commonly used for domestic and international transactions. In Tanzania, the Electronic Funds Transfer System (EFTS) is widely used for local transactions. While EFTS may not be as common for international transfers, it can be a viable alternative in certain situations.

- Mobile Money: With the rise of mobile payment platforms, mobile money services have become increasingly popular in Tanzania. Platforms such as M-Pesa allow users to send and receive money domestically and internationally using their mobile phones. While not a direct alternative to the Swift Code, mobile money services provide a convenient and accessible option for certain types of transactions.

When considering alternatives to the Swift Code, it is important to assess the specific requirements of your transaction and choose the method that best suits your needs. Consulting with your bank or financial institution can provide valuable insights and guidance on the most appropriate option.

Benefits of using the Bank of Africa Tanzania swift code

Utilizing the Bank of Africa Tanzania Swift Code offers several benefits for international transactions:

- Accuracy and Efficiency: The Swift Code ensures accurate and efficient processing of international transfers. By providing the precise identification of the bank and branch involved, it minimizes the risk of errors or delays in the transaction.

- Global Recognition: The Swift Code is the globally recognized standard for identifying banks. Using the Bank of Africa Tanzania Swift Code allows for seamless communication and coordination between different financial institutions worldwide, ensuring smooth and secure transactions.

- Widely Accepted: The Bank of Africa Tanzania Swift Code is accepted by banks and financial institutions around the world. This means you can send or receive funds from various countries without worrying about compatibility or acceptance issues.

- Regular Updates: Banks often update their Swift Codes due to various reasons, such as mergers, acquisitions, or branch relocations. By using the Bank of Africa Tanzania website or reliable search engines, you can stay up to date with any changes or updates to the Swift Code, ensuring the most accurate information for your transactions.

By taking advantage of the benefits offered by the Bank of Africa Tanzania Swift Code, you can streamline your international banking experience and enjoy hassle-free transactions.

Common mistakes to avoid when using swift codes for international transactions

While using the Bank of Africa Tanzania Swift Code is generally straightforward, there are some common mistakes that should be avoided to ensure smooth international transactions:

- Using outdated codes: Swift Codes can change over time due to various reasons, such as bank mergers, branch relocations, or system updates. Always double-check the Swift Code before initiating an international transaction to ensure you have the most up-to-date information.

- Incorrectly entering the code: The Swift Code is a combination of letters and numbers, and it is essential to enter it accurately. Even a single digit or letter error can result in the funds being sent to the wrong bank or branch. Take your time when entering the code and verify it multiple times before confirming the transaction.

- Not including the correct beneficiary details: In addition to the Swift Code, it is crucial to provide the correct beneficiary details, including the recipient’s full name, account number, and any additional information required by the receiving bank. Neglecting to include these details can lead to delays or complications in the transaction.

- Not consulting with the bank: If you have any doubts or questions regarding the Swift Code or international transactions, it is always best to consult with your bank or financial institution. They can provide guidance and ensure you have the correct information for a smooth transaction.

By being aware of these common mistakes and taking the necessary precautions, you can avoid unnecessary complications and ensure the success of your international transactions.

Tips for a smooth international transaction using the Bank of Africa Tanzania swift code

To ensure a smooth and successful international transaction using the Bank of Africa Tanzania Swift Code, consider the following tips:

- Double-check all details: Before initiating the transaction, verify all the details, including the Swift Code, beneficiary information, and transaction amount. A simple mistake can cause delays or complications, so it is crucial to be thorough.

- Allow sufficient time: International transactions may take longer to process compared to domestic transfers. Factors such as time zone differences, banking holidays, and additional security measures can impact the processing time. Plan ahead and allow for any potential delays.

- Consider transaction fees and exchange rates: International transactions often involve fees and exchange rate conversions. Familiarize yourself with the applicable fees and exchange rates provided by Bank of Africa Tanzania to understand the total cost of your transaction.

- Keep records and documentation: It is essential to keep records of your international transactions, including transaction confirmations, receipts, and any related correspondence. These documents can serve as proof of the transaction and may be required for future reference or dispute resolution.

- Monitor your account: After completing the international transaction, regularly monitor your bank account to ensure the funds have been successfully transferred. If you notice any discrepancies or issues, contact your bank immediately for assistance.

By following these tips, you can navigate the international banking process with confidence and ensure a smooth and hassle-free experience using the Bank of Africa Tanzania Swift Code.

Additional resources for understanding and using swift codes

If you would like to further enhance your understanding of Swift Codes and their usage, here are some additional resources you may find helpful:

- Bank of Africa Tanzania Website: Visit the Bank of Africa Tanzania website for specific information about their Swift Code and international banking services. The website may also provide additional resources or FAQs to answer any questions you may have.

- Swift Code Databases: There are various online platforms that provide comprehensive databases of Swift Codes for banks worldwide. These databases allow you to search for specific banks or browse through the available Swift Codes. Some popular databases include the Society for Worldwide Interbank Financial Telecommunication (SWIFT) website and websites specializing in Swift Code searches.

- Banking Forums and Communities: Participating in online banking forums or communities can provide valuable insights and experiences from individuals who have previously dealt with international transactions. You can ask questions, seek advice, and learn from the experiences of others.

- Bank Customer Support: If you have specific questions or require assistance regarding Swift Codes or international transactions, reach out to Bank of Africa Tanzania’s customer support. They are trained to provide guidance and support for their customers.

By utilizing these additional resources, you can enhance your knowledge and make informed decisions when it comes to using Swift Codes for international transactions.

Simplifying international transactions with the Bank of Africa Tanzania swift code

In conclusion, the Bank of Africa Tanzania Swift Code simplifies international transactions. By understanding the structure of the Swift Code and how to find it, you can ensure accurate and efficient processing of funds. The Bank of Africa Tanzania Swift Code offers several benefits, such as accuracy, global recognition, and regular updates. It is important to avoid common mistakes and follow the tips provided to ensure a smooth international transaction. You can further enhance your knowledge and make informed decisions by utilizing additional resources and consulting with your bank. Simplify your international banking experience with Bank of Africa Tanzania’s Swift Code and enjoy seamless cross-border transactions.

For more articles related to Financial Services in Tanzania, click here!