Unlocking the Value: Understanding the Exchange Rate of 60,000 Tanzanian Shillings to USD

Are you planning a trip to Tanzania and wondering about the exchange rate of 60000 Tanzanian Shillings to USD? Understanding the value of your currency in relation to the US dollar is essential for budgeting and making informed decisions while travelling. In this article, we will unlock the value of 60,000 Tanzanian Shillings, providing you with a comprehensive understanding of its worth in USD.

Tanzania is a diverse and culturally rich country, attracting travelers from around the world. Whether you’re exploring the Serengeti National Park or relaxing on the pristine beaches of Zanzibar, knowing the exchange rate will help you navigate your expenses with confidence.

At the current exchange rate, 60,000 Tanzanian Shillings converts to approximately $26.22 USD. However, it’s important to note that exchange rates fluctuate, so it’s advisable to check the latest rates before your trip.

Join us as we delve into the exchange rate of 60000 Tanzanian Shillings to USD, empowering you with the knowledge to make the most of your time and money in Tanzania. Let’s unlock the value together!

Factors influencing the exchange rate

The exchange rate of a currency is determined by the supply and demand of that currency in the global market. Several factors can influence the demand and supply of a currency, leading to fluctuations in the exchange rate. Some of the factors that influence the exchange rate of 60000 Tanzanian Shillings to USD include:

1. Political stability

The political stability of a country can have a significant impact on its exchange rate. Political instability, civil unrest, and conflicts can lead to a decrease in the demand for a currency, leading to a decline in its value. On the other hand, a stable political environment can increase the demand for a currency, leading to an increase in its value.

2. Economic performance

The economic performance of a country can also affect its exchange rate. A strong economy with high GDP growth, low inflation, and low unemployment rates can attract foreign investors, leading to an increase in the demand for the country’s currency. On the other hand, a weak economy with high inflation, high unemployment rates, and low GDP growth can lead to a decrease in the demand for a currency, leading to a decline in its value.

3. Interest rates

Interest rates can also influence the exchange rate of a currency. A higher interest rate in a country can attract foreign investors, leading to an increase in the demand for its currency and an increase in its value. Conversely, a low-interest rate can lead to a decrease in the demand for a currency, leading to a decline in its value.

Historical overview of the Tanzanian Shilling to USD exchange rate

The Tanzanian Shilling (TZS) has had a fluctuating exchange rate against the US Dollar (USD) over the years. In the early 1990s, the exchange rate was approximately 300 TZS to 1 USD. However, by the end of the decade, the exchange rate had depreciated to around 800 TZS to 1 USD.

In the early 2000s, the Tanzanian government implemented several economic reforms, leading to a stable exchange rate. From 2005 to 2012, the exchange rate was relatively stable at around 1,400 TZS to 1 USD. However, in recent years, the exchange rate has fluctuated, with the TZS depreciating against the USD.

As of August 2021, the exchange rate of 60,000 Tanzanian Shillings to USD is approximately $26.22 USD.

Current exchange rate trends and fluctuations

The exchange rate of 60000 Tanzanian Shillings to USD is subject to fluctuations due to several factors, including political instability, economic performance, and interest rates.

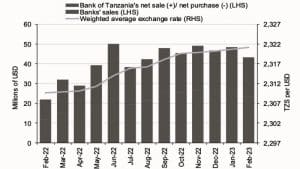

In 2020, the COVID-19 pandemic had a significant impact on the global economy, leading to a decline in the value of currencies worldwide. The Tanzanian Shilling was not spared, as it depreciated against the US dollar, reaching a low of 2,319.20 TZS to 1 USD in May 2020. However, the exchange rate has since stabilized, and as of August 2021, it is at approximately 2,287.50 TZS to 1 USD.

Economic impact of the exchange rate on Tanzania

The exchange rate of 60000 Tanzanian Shillings to USD has a significant impact on the Tanzanian economy, as it affects international trade, investment, and tourism.

A weak Tanzanian Shilling can make imports more expensive, leading to higher inflation and a decrease in the purchasing power of consumers. On the other hand, a strong Tanzanian Shilling can make exports more expensive, making them less competitive in the global market.

Additionally, a weak Tanzanian Shilling can make foreign investment more attractive, leading to an increase in foreign capital inflows. However, a strong Tanzanian Shilling can deter foreign investment, as it makes domestic assets more expensive.

Finally, the exchange rate can also affect tourism, as it affects the affordability of travel for international visitors. A weak Tanzanian Shilling can make Tanzania a more affordable destination, leading to an increase in tourism. On the other hand, a strong Tanzanian Shilling can make Tanzania less affordable, leading to a decrease in tourism.

How the exchange rate affects tourism and exports

Tourism and exports are essential sectors of the Tanzanian economy, and their performance is closely tied to the exchange rate of Tanzanian Shillings to USD.

A weak Tanzanian Shilling can make Tanzanian exports more competitive in the global market, as they become more affordable for foreign buyers. This can lead to an increase in export revenue and boost the country’s economic growth.

On the other hand, a strong Tanzanian Shilling can make exports less competitive in the global market, leading to a decrease in export revenue. Additionally, a strong Tanzanian Shilling can make Tanzania a less affordable destination for international tourists, leading to a decrease in tourism revenue.

Tips for travelers and businesses dealing with the exchange rate

If you’re planning a trip to Tanzania or doing business in the country, there are several tips to keep in mind when dealing with the exchange rate.

1. Check the latest exchange rates

Exchange rates are subject to fluctuations, so it’s essential to stay up-to-date with the latest rates. You can check the latest exchange rates online or at a currency exchange bureau.

2. Use credit cards or ATMs

Using a credit card or ATM is often the most convenient way to access cash while traveling. However, it’s important to check your bank’s foreign transaction fees and exchange rates to avoid unnecessary charges.

3. Carry some cash

Carrying some cash is always a good idea, as it can come in handy in case of emergencies or when traveling to remote areas where credit cards may not be accepted.

4. Negotiate prices

If you’re doing business in Tanzania, negotiating prices can help you get the best deal. Keep in mind that a weak Tanzanian Shilling can make imports more expensive, so it’s essential to factor in the exchange rate when negotiating prices.

Strategies for managing currency risk

Managing currency risk is essential for businesses operating in Tanzania. Here are some strategies to consider:

1. Hedging

Hedging involves using financial instruments to protect against adverse currency movements. For example, a business can use a forward contract to lock in a specific exchange rate for future transactions.

2. Diversification

Diversification involves spreading risk across different currencies. For example, a business can maintain accounts in different currencies to reduce its exposure to currency risk.

3. Monitoring

Monitoring involves keeping a close eye on the exchange rate and adjusting business strategies accordingly. For example, a business can adjust its pricing or sourcing strategies in response to currency fluctuations.

Exchange rate forecasting and analysis

Exchange rate forecasting and analysis can help businesses and investors make informed decisions. There are several methods for forecasting exchange rates, including:

1. Technical analysis

Technical analysis involves analyzing past price and volume data to identify trends and predict future price movements.

2. Fundamental analysis

Fundamental analysis involves analyzing economic and political factors to predict future price movements. For example, a business can analyze GDP growth, inflation, and interest rates to predict the exchange rate.

3. Sentiment analysis

Sentiment analysis involves analyzing market sentiment to predict future price movements. For example, a business can analyze news and social media sentiment to predict the exchange rate.

Understanding the value of the Tanzanian Shilling to USD

In conclusion, understanding the exchange rate of 60000 Tanzanian Shillings to USD is essential for travelers and businesses operating in Tanzania. The exchange rate is subject to fluctuations due to several factors, including political stability, economic performance, and interest rates.

A weak Tanzanian Shilling can make imports more expensive, lead to higher inflation, and decrease the purchasing power of consumers. However, it can also make exports more competitive and attract foreign investment.

Conversely, a strong Tanzanian Shilling can make exports less competitive and deter foreign investment. It can also make Tanzania a less affordable destination for international tourists, leading to a decrease in tourism revenue.

By understanding the exchange rate of Tanzanian Shillings to USD and implementing strategies to manage currency risk, businesses and investors can make informed decisions and maximize their profits. For travelers, understanding the exchange rate can help with budgeting and making informed decisions while exploring the beautiful country of Tanzania.

For more articles related to Financial Services in Tanzania, click here!