Investing in Tanzanian Gold Corporation: Exploring the Factors Behind the Share Price Surge

In the dynamic world of investing, few industries capture the imagination quite like the gold market. And when it comes to the Tanzanian Gold Corporation, the recent surge in the Tanzanian gold corporation share price has left many investors intrigued. What exactly is driving this upward trend and what factors should savvy investors consider before diving into this opportunity? In this article, we will delve into the key factors behind the share price surge of Tanzanian Gold Corporation, exploring the company’s exploration success, strategic partnerships, and the broader market trends that have contributed to its growth. Whether you’re a seasoned investor looking for the next big opportunity or a curious observer seeking insights into the gold market, join us as we uncover the factors propelling Tanzanian Gold Corporation to new heights.

Overview of the Gold Mining Industry in Tanzania

Tanzania has a rich history in gold mining, with the precious metal playing a significant role in the country’s economy. The country is known for its vast reserves of gold, attracting both local and international mining companies. The Tanzanian gold share price has witnessed substantial growth in recent years, driven by favorable government policies, increased exploration activities, and rising global gold prices.

Tanzanian Gold Corporation is one of the leading players in this industry, with a strong presence and a track record of success. The company’s focus on environmentally responsible mining practices and its commitment to community development have helped it establish a positive reputation within the industry and its relentless effort in the gold industry has led to the continuous rise of the Tanzanian gold corporation share price.

Analysis of Tanzanian Gold Corporation’s Financial Performance

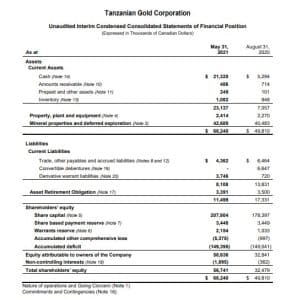

To understand the factors behind Tanzanian gold share price surge, it is essential to analyze the company’s financial performance. The company has experienced robust revenue growth in recent years, driven by increased gold production and higher gold prices. Tanzanian Gold Corporation’s financial statements demonstrate a strong balance sheet, with healthy cash flows and a solid reserve base.

The company’s profitability ratios, such as gross margin and net profit margin, have also shown improvement, indicating efficient cost management and operational effectiveness. These positive financial indicators have undoubtedly contributed to the market’s positive sentiment towards Tanzanian gold corporation share price.

Exploration and Production Projects of Tanzanian Gold Corporation

Tanzanian Gold Corporation’s exploration and production projects are a key driver of its Tanzanian gold share price surge. The company has strategically focused on expanding its mining operations and discovering new gold reserves. Its flagship project, the Buckreef Gold Mine, has shown promising results, with significant gold mineralization and high-grade intercepts.

In addition to the Buckreef Gold Mine, Tanzanian Gold Corporation has other exploration projects in various stages of development. These projects provide the company with potential future growth opportunities and further bolster investor confidence in the Tanzanian gold corporation share price.

Regulatory and Political Factors Affecting the Company’s Operations

Like any mining company, Tanzanian Gold Corporation operates within a regulatory framework and is subject to political influences. It is crucial for investors to be aware of the regulatory and political factors that could impact the company’s operations and ultimately its Tanzanian gold share price.

Over the years, Tanzania has made efforts to strengthen its mining regulations to ensure fair and transparent operations. While these regulations aim to protect the country’s natural resources and promote responsible mining practices, changes in regulations can sometimes create uncertainty for mining companies and these changes and the uncertainty that surrounds it can heavily impact the Tanzanian gold corporation share price.

Political stability is another crucial factor to consider when investing in Tanzanian Gold Corporation. Any political instability or changes in government policies can have a significant impact on the company’s operations, profitability and the Tanzanian gold share price.

Competitor Analysis and Market Trends

To gain a comprehensive understanding of the Tanzanian gold corporation share price surge, it is essential to analyze the company within the context of its competitors and broader market trends. This analysis allows investors to evaluate the company’s competitive position and assess its growth potential.

Tanzanian Gold Corporation faces competition from both local and international mining companies operating in Tanzania. This competition can at times lead to fluctuations in the Tanzanian gold share price. Understanding the competitive landscape helps investors identify the company’s unique selling points and its ability to differentiate itself from its peers.

Market trends also play a crucial role in determining the share price performance of Tanzanian Gold Corporation. Factors such as global gold prices, supply and demand dynamics, and investor sentiment towards gold as an investment asset class can influence the Tanzanian gold corporation share price.

Expert Opinions and Investor Sentiment Towards Tanzanian Gold Corporation

Expert opinions and investor sentiment are valuable indicators when assessing the potential of an investment opportunity. It is essential to consider the views of industry experts and the sentiment of institutional and retail investors towards the Tanzanian Gold Corporation and the Tanzanian gold share price.

Analysts covering the gold mining sector often provide insights into the company’s prospects, financial performance, and industry trends. These opinions can help investors make informed decisions and identify potential risks and opportunities associated with investing in the Tanzanian gold corporation share price.

Investor sentiment, which is influenced by factors such as news, macroeconomic conditions, and market trends, can also impact the Tanzanian gold share price. Monitoring investor sentiment provides valuable insights into how the market perceives the company and its growth prospects.

Risks and Challenges Associated With Investing in the Company

While the Tanzanian gold corporation share price surge may seem enticing, it is important to consider the risks and challenges associated with investing in the company. Like any investment, there are inherent risks involved that investors must evaluate before making a decision.

Geopolitical risks, regulatory changes, and operational challenges are some of the key risks that investors should be aware of. For example, changes in mining regulations or political instability in Tanzania can impact the company’s operations, profitability and the Tanzanian gold share price.

Operational risks, such as production disruptions, cost overruns, and technical difficulties, can also affect the company’s profitability which can lead to a dip in the Tanzanian gold corporation share price. Investors should carefully assess these risks and evaluate the company’s ability to mitigate and manage them effectively.

Conclusion and Final Thoughts on Investing in Tanzanian Gold Corporation

In conclusion, the Tanzanian gold share price surge can be attributed to a combination of factors, including exploration success, strategic partnerships, and favorable market trends. The company’s strong financial performance, coupled with its focus on responsible mining practices, has positioned it as a key player in the gold mining industry in Tanzania.

However, investing in the Tanzanian gold corporation share price is not without risks. Investors should carefully consider the regulatory and political factors, competition, and operational challenges associated with the company. Conducting thorough due diligence and seeking professional advice is essential to make informed investment decisions in the gold mining sector.

Overall, Tanzanian Gold Corporation presents an exciting investment opportunity for those interested in the gold market. By understanding the factors driving its Tanzanian gold share price surge and diligently assessing the associated risks, investors can make informed decisions and potentially benefit from the company’s growth prospects.

For more related articles on Manufacturing and Business in Tanzania (Trade) click here!