Navigating the Forex Market: An Insider’s Guide to the USD vs Tanzanian Shilling Exchange Rate

Are you curious about the exciting world of Forex trading? Interested in the USD vs Tanzanian Shilling exchange rate? Look no further! In this insider’s guide, we will dive deep into the Forex market and explore the intricacies of trading the USD against the Tanzanian Shilling.

As a beginner in Forex, it can be daunting to navigate through the complex world of currency trading. But fear not! We will break down key concepts, explain how the exchange rate works, and provide valuable insights to help you make informed trading decisions.

Whether you’re a seasoned trader or just starting out, understanding the USD vs Tanzanian Shilling exchange rate is essential. The economies of these two countries play a significant role in determining the strength of their respective currencies. By gaining insights into economic factors and market trends, you’ll be better equipped to predict and capitalize on currency fluctuations.

So, get ready to chart your course through the Forex market! Join us as we explore the fascinating world of USD vs Tanzanian Shilling trading and unlock the potential for profitable opportunities.

Understanding the USD vs Tanzanian Shilling exchange rate

To navigate the Forex market effectively, it’s crucial to understand the USD vs Tanzanian Shilling exchange rate. The exchange rate represents the value of one currency in terms of another. In this case, it indicates how many Tanzanian Shillings are needed to buy one US Dollar. The exchange rate is determined by various factors such as supply and demand, interest rates, inflation, and political stability.

The USD is considered a major currency and is widely accepted in global trade and finance. On the other hand, the Tanzanian Shilling is the official currency of Tanzania and is primarily used within the country. The exchange rate between these two currencies is influenced by the economic performance of both nations and the demand for their respective currencies.

Historically, the USD has been stronger than the Tanzanian Shilling due to the United States’ status as a global economic powerhouse. However, the exchange rate can fluctuate based on market conditions and economic developments. It’s important to stay updated on the latest news and trends to make informed trading decisions.

Factors influencing the exchange rate

Several factors influence the USD vs Tanzanian Shilling exchange rate. Understanding these factors can help you anticipate currency movements and make informed trading decisions. Here are some key factors to consider:

- Economic indicators: Economic indicators such as GDP growth, inflation rates, and employment data can have a significant impact on currency values. Positive economic indicators in the United States may strengthen the USD, while favorable economic conditions in Tanzania can boost the Tanzanian Shilling.

- Interest rates: Central banks play a crucial role in setting interest rates, which can influence the exchange rate. Higher interest rates in the United States compared to Tanzania can attract foreign investors seeking better returns, potentially strengthening the USD.

- Political stability: Political stability is an important factor in determining a currency’s value. Countries with stable political environments tend to attract foreign investment, which can strengthen their currencies. On the other hand, political instability can lead to a depreciation in currency value.

- International trade: The balance of trade between countries can impact the exchange rate. If Tanzania exports more goods and services to the United States than it imports, there will be a demand for Tanzanian Shillings, potentially strengthening the currency.

- Market sentiment: Market sentiment and investor confidence can influence currency movements. Factors such as geopolitical events, global economic trends, and investor risk appetite can all impact the exchange rate.

By analyzing these factors and keeping track of relevant news and economic indicators, you can gain insights into the potential direction of the USD vs Tanzanian Shilling exchange rate.

Historical trends and patterns

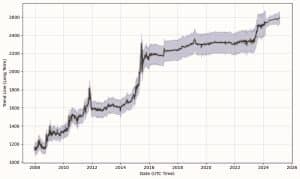

Analyzing historical trends and patterns can provide valuable insights into the USD vs Tanzanian Shilling exchange rate. By examining past performance, you can identify recurring patterns and make more informed trading decisions. Here are some historical trends to consider:

- Long-term trends: Over the years, the USD has generally been stronger than the Tanzanian Shilling. This trend is driven by the economic dominance of the United States and its position as a global reserve currency. However, there have been periods of volatility and fluctuations caused by various economic and geopolitical factors.

- Seasonal trends: Seasonal trends can impact currency movements. For example, increased tourism during certain months in Tanzania can lead to a higher demand for Tanzanian Shillings, potentially strengthening the currency.

- Correlations: Examining correlations between the USD vs Tanzanian Shilling and other currency pairs can provide insights into potential movements. For example, if the USD is strengthening against other major currencies, it may also impact its value against the Tanzanian Shilling.

Analyzing historical trends and patterns should be done in conjunction with current market analysis to account for changing economic conditions and global events. It’s essential to consider multiple factors and use technical and fundamental analysis to make well-informed trading decisions.

Analyzing the USD vs Tanzanian Shilling exchange rate

Analyzing the USD vs Tanzanian Shilling exchange rate involves using various tools and techniques to assess the market and potential trading opportunities. Here are some common methods used by Forex traders:

- Technical analysis: Technical analysis involves studying price charts and using indicators to identify trends, support and resistance levels, and potential entry and exit points. Traders use tools such as moving averages, oscillators, and trendlines to analyze historical price data and make predictions about future price movements.

- Fundamental analysis: Fundamental analysis focuses on evaluating economic factors, news events, and market sentiment to determine the intrinsic value of a currency. By analyzing economic indicators, monetary policies, and geopolitical developments, traders can assess the potential impact on the exchange rate and make trading decisions based on their findings.

- Sentiment analysis: Sentiment analysis involves gauging market sentiment and investor behavior to anticipate currency movements. This can be done through analyzing news sentiment, social media sentiment, and market positioning data. Traders often use sentiment indicators and sentiment-based strategies to gain insights into market sentiment and make trading decisions accordingly.

Combining these analysis techniques can provide a comprehensive view of the USD vs Tanzanian Shilling exchange rate, helping traders make well-informed decisions based on both technical and fundamental factors.

Strategies for navigating the Forex market

Navigating the Forex market requires a well-defined trading strategy and disciplined approach. Here are some strategies that can help you navigate the USD vs Tanzanian Shilling exchange rate:

- Trend following: Trend following strategies involve identifying and trading in the direction of the prevailing trend. Traders using this strategy would look for signals indicating a strong upward or downward trend and enter trades accordingly.

- Range trading: Range trading involves identifying price ranges or support and resistance levels and trading within those boundaries. Traders using this strategy would look to buy near support levels and sell near resistance levels.

- Breakout trading: Breakout trading involves entering trades when the price breaks above or below a significant level of support or resistance. Traders using this strategy would look for strong breakouts and enter trades in the direction of the breakout.

- News trading: News trading involves taking advantage of significant news events and their impact on the exchange rate. Traders using this strategy would monitor economic calendars and news releases to identify potential trading opportunities.

It’s important to note that no strategy guarantees success in the Forex market. Each strategy has its strengths and weaknesses, and traders should carefully analyze market conditions and adapt their strategies accordingly.

Tips for trading USD vs Tanzanian Shilling

Trading the USD vs Tanzanian Shilling can be rewarding, but it’s essential to approach it with caution and follow best practices. Here are some tips to keep in mind:

- Stay informed: Stay updated on the latest news, economic indicators, and market trends. This will help you make informed trading decisions and anticipate potential currency movements.

- Manage risk: Implement proper risk management techniques such as setting stop-loss orders and managing position sizes. This will help protect your capital and minimize potential losses.

- Use leverage wisely: Leverage can amplify both profits and losses. Use leverage conservatively and understand the risks involved before trading with leverage.

- Practice on a demo account: Before trading with real money, practice on a demo account to familiarize yourself with the trading platform and test your strategies in a risk-free environment.

- Keep emotions in check: Emotions can cloud judgment and lead to irrational trading decisions. Stick to your trading plan and avoid making impulsive trades based on fear or greed.

By following these tips and continuously improving your trading skills, you can increase your chances of success in trading the USD vs Tanzanian Shilling.

Risks and challenges in Forex trading

Forex trading comes with inherent risks and challenges that traders need to be aware of. Here are some key risks and challenges to consider:

- Volatility: The Forex market is highly volatile, meaning that currency prices can fluctuate rapidly. Volatility can lead to both profit opportunities and significant losses if not managed properly.

- Leverage: While leverage can amplify profits, it can also magnify losses. Trading with leverage requires careful risk management and an understanding of the potential impact of leverage on your trading account.

- Market manipulation: Market manipulation can occur in the Forex market, particularly in less regulated environments. Traders should be cautious of fraudulent activities and ensure they trade on reputable platforms.

- Lack of control: Traders have limited control over market movements and are subject to various external factors. It’s important to accept that not all trades will be profitable and to focus on long-term profitability rather than individual trades.

- Continuous learning: The Forex market is dynamic, and traders need to continuously learn and adapt to changing market conditions. Staying updated on market trends, new trading strategies, and technological advancements is essential for long-term success.

By being aware of these risks and challenges, traders can take appropriate measures to mitigate them and improve their chances of success in the Forex market.

Resources for staying updated on the exchange rate

Staying updated on the USD vs Tanzanian Shilling exchange rate and related market news is crucial for successful Forex trading. Here are some resources to help you stay informed:

- Economic calendars: Economic calendars provide a schedule of upcoming economic events and their expected impact on the market. Websites and trading platforms often offer economic calendars that can help you stay updated on key events.

- Financial news websites: Financial news websites such as Bloomberg, Reuters, and CNBC provide real-time news updates, market analysis, and expert opinions. Subscribing to newsletters or following these websites on social media can help you stay informed.

- Central bank websites: Central bank websites, such as the Federal Reserve’s website for the United States and the Bank of Tanzania’s website, provide important information on monetary policy decisions, economic outlooks, and official statements.

- Forex forums and communities: Participating in Forex forums and communities can provide valuable insights and discussions on currency trading. Engaging with experienced traders can help you learn new strategies and gain insights into the market.

- Trading platforms: Many trading platforms offer real-time market data, charts, and analysis tools. These features can help you analyze the USD vs Tanzanian Shilling exchange rate and make informed trading decisions.

By utilizing these resources and staying updated on market news and trends, you can stay ahead of the curve and make more informed trading decisions.

Navigating the Forex market and trading the USD vs Tanzanian Shilling exchange rate can be challenging but rewarding. By understanding the key concepts, analyzing factors influencing the exchange rate, and using appropriate strategies, you can increase your chances of success in Forex trading.

Remember to stay informed, manage risk effectively, and continuously improve your trading skills. The Forex market offers exciting opportunities for profit, but it’s essential to approach it with caution and discipline.

So, chart your course through the Forex market, explore the fascinating world of USD vs Tanzanian Shilling trading, and unlock the potential for profitable opportunities. Happy trading!

For more articles related to Financial Services in Tanzania, click here!