The Impact of Inflation in Tanzania 2021: What You Need to Know

Introduction to Inflation and Its Impact

Inflation, a term that economists frequently use, refers to the increase in the general price level of goods and services in an economy over time. It is an important economic indicator that can have a significant impact on individuals, businesses, and overall economic stability. The inflation rate in Tanzania 2021 has been a topic of concern for many. This article aims to provide a comprehensive understanding of the Tanzania inflation rate 2021 and its impact on the economy, businesses, and consumers, as well as strategies to cope with inflation.

Understanding the Inflation Rate in Tanzania in 2021

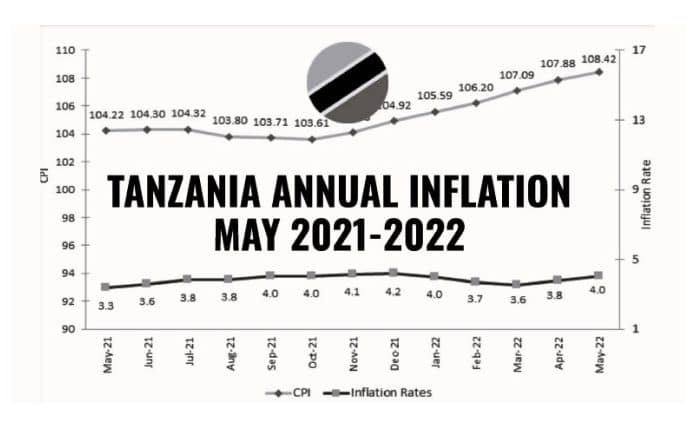

To comprehend the Tanzania inflation rate 2021, it is essential to examine the Consumer Price Index (CPI), which measures changes in the average prices of a basket of goods and services consumed by households. In January 2021, Tanzania recorded an inflation rate of 3.5%, which was relatively low compared to previous years. However, economists projected that the inflation rate would gradually increase due to various factors.

Factors Contributing to Inflation in Tanzania

Several factors contribute to inflation in Tanzania. One significant factor is the increase in the cost of imported goods. Tanzania heavily relies on imported products, and any fluctuations in global prices can have a direct impact on the local economy. Additionally, the depreciation of the Tanzanian shilling against major currencies can also lead to inflation. When the value of the local currency decreases, the cost of imported goods rises, resulting in higher prices for consumers.

Another factor that contributed to the Tanzania inflation rate 2021 is excessive government spending. When the government spends more than it generates in revenue, it creates a budget deficit that is often financed by borrowing or printing more money. This increased money supply in the economy can lead to higher inflation rates. Moreover, changes in global oil prices and weather conditions can affect the prices of fuel and agricultural products, respectively, which in turn can influence inflation in Tanzania.

Effects of Inflation on the Tanzanian Economy

Inflation can have numerous effects on the Tanzanian economy. One of the primary consequences is the erosion of purchasing power. When prices rise, the same amount of money can buy fewer goods and services, causing a decrease in the standard of living for individuals and households. This can lead to reduced consumption, lower savings, and overall economic instability.

Additionally, inflation can negatively impact investments. Uncertainty about future prices can discourage businesses from making long-term investments, leading to lower economic growth and job creation. Furthermore, inflation can distort price signals in the economy, making it challenging for businesses to determine the true value of goods and services. This can result in inefficient resource allocation and decreased productivity.

Impact of Inflation on Businesses and Consumers

Businesses and consumers both experience the effects of inflation. For businesses, inflation can increase production costs, particularly if they rely on imported raw materials or have high energy consumption. This can squeeze profit margins and make it difficult for businesses to remain competitive. Moreover, inflation can also lead to higher interest rates, making it more expensive for businesses to borrow money for expansion or investment.

Consumers, on the other hand, face the direct impact of inflation through higher prices. As the cost of goods and services increases, consumers may need to adjust their spending habits and reduce discretionary expenses. This can result in lower overall consumption and economic activity. Additionally, inflation can erode the value of savings, as the interest earned may not keep pace with the rising prices. This can negatively affect individuals’ financial security and long-term planning.

Strategies to Cope with Inflation in Tanzania

While inflation can have significant impacts, there are strategies that individuals, businesses, and the government can employ to cope with its effects. One effective strategy is to diversify investments. By spreading investments across different asset classes, such as stocks, bonds, and real estate, individuals can mitigate the risk of inflation eroding the value of their savings. Similarly, businesses can diversify their supply chains and explore local sourcing options to reduce reliance on imported goods.

Another strategy to curb the inflation rate in Tanzania 2021 is to focus on productivity and innovation. Businesses that continuously strive to improve their efficiency and develop innovative products or services are better equipped to withstand the effects of inflation. By streamlining operations, reducing waste, and investing in research and development, businesses can maintain their competitiveness and potentially offset the impact of inflation on costs.

Government Policies to Combat Inflation

The Tanzanian government plays a crucial role in managing inflation through various policies. One of the primary tools at its disposal is monetary policy, which is implemented by the central bank. Through the adjustment of interest rates and the regulation of money supply, the central bank can influence borrowing costs and inflation expectations. Additionally, the government can implement fiscal policies, such as controlling government spending and managing the budget deficit, to reduce inflationary pressures.

The government can also promote price stability by encouraging competition and ensuring market efficiency. By fostering a competitive environment, businesses are incentivized to keep prices in check and improve productivity. Furthermore, the government can invest in infrastructure development, education, and healthcare to enhance the productive capacity of the economy and reduce supply-side constraints that contribute to inflation.

Predictions for Inflation in Tanzania in 2021

While predicting inflation with absolute certainty is challenging, economists and analysts make projections based on various indicators and factors. In the case of the Tanzania inflation rate 2021, it is anticipated that the inflation rate will gradually increase throughout the year. Factors such as rising global oil prices, volatility in exchange rates, and the impact of the COVID-19 pandemic on supply chains and consumer demand are expected to contribute to inflationary pressures.

Furthermore, the government’s response to these challenges and its ability to implement effective policies will also play a role in determining the inflation rate. It is crucial for policymakers to strike a balance between promoting economic growth and maintaining price stability to ensure sustainable development.

How Individuals Can Protect Themselves from the Effects of Inflation

While individuals cannot control the overall inflation rate, they can take steps to protect themselves from its effects. One strategy is to invest in assets that tend to perform well during inflationary periods, such as real estate or commodities like gold and silver. These assets have historically maintained their value or even appreciated during times of high inflation.

Additionally, individuals can focus on building a diversified portfolio that includes a mix of investments, such as stocks, bonds, and inflation-protected securities. This diversification can help mitigate the impact of inflation on their overall wealth. Moreover, individuals can consider adjusting their spending habits and prioritizing essential expenses to cope with rising prices.

Inflation is an economic phenomenon that can have far-reaching impacts on individuals, businesses, and the overall economy. Understanding the Tanzania inflation rate 2021 and its effects is crucial for making informed financial decisions and developing strategies to cope with inflationary pressures. By diversifying investments, focusing on productivity, and implementing effective government policies, Tanzania can navigate the challenges posed by inflation and achieve sustainable economic growth. Individuals can also protect themselves by investing in inflation-resistant assets and adjusting their spending habits. With a comprehensive understanding of inflation and its impact, stakeholders can better navigate the economic landscape and strive for a more prosperous future.

For more articles related to Financial Services in Tanzania, click here!