Unlocking the Potential: Making the Most of 5 Million Tanzanian Shillings for Investment Opportunities

Are you ready to turn 5 million Tanzanian shillings into a thriving investment portfolio? Look no further, as this article will guide you through the realm of investment opportunities. With a focus on the Tanzanian market, we will explore the diverse sectors that offer potential for growth and profitability.

Tanzania, the largest economy in East Africa, is undergoing rapid development, making it an attractive destination for investors. From agriculture to manufacturing, infrastructure to renewable energy, there are numerous sectors poised for expansion. This article will provide you with valuable insights on where to allocate your investment to maximize returns.

Whether you are a seasoned investor or a novice looking to make your mark, this comprehensive guide will help you navigate the Tanzanian investment landscape with confidence. We will cover the latest market trends, potential risks, and strategies to optimize your investment returns.

Don’t miss out on the opportunity to make the most of your 5 million Tanzanian shillings. Join us as we unlock the potential and uncover the hidden gems that can help grow your wealth in Tanzania’s vibrant economy.

Understanding the Tanzanian Economy

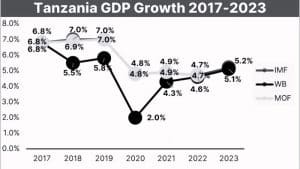

To make informed investment decisions, it is crucial to understand the underlying factors that shape the Tanzanian economy. Tanzania has experienced steady economic growth over the past decade, averaging around 6-7% annually. The country has a diverse economy, with agriculture, mining, manufacturing, and services contributing significantly to its GDP.

The agricultural sector, which employs a large portion of the population, presents attractive investment opportunities. Tanzania is known for its rich agricultural resources, including fertile land, favorable climate conditions, and a wide range of crops. Investing in agribusiness, such as crop production, livestock farming, or processing and packaging, can yield substantial returns.

Additionally, Tanzania’s natural resources, including minerals and gas reserves, have attracted foreign investors and contributed to economic growth. The mining sector offers opportunities for investment in exploration, extraction, and mineral processing. With a stable legal framework and government support, the mining industry in Tanzania is set to expand further.

Infrastructure development is another key area for investment in Tanzania. The government has prioritized infrastructure projects, such as roads, railways, ports, and airports, to support economic growth. Investing in infrastructure-related industries, such as construction, logistics, or telecommunications, can be highly lucrative.

Investment Opportunities in Tanzania

Now that we have a better understanding of the Tanzanian economy, let’s explore some specific investment opportunities that can be pursued with 5 million Tanzanian shillings.

- Real Estate: The demand for residential and commercial properties in major urban centers like Dar es Salaam and Arusha is steadily increasing. Investing in real estate can provide stable rental income and the potential for capital appreciation. Consider purchasing land for development or investing in residential or commercial properties in prime locations.

- Tourism: Tanzania is famous for its wildlife, national parks, and beautiful landscapes, making it a popular tourist destination. Investing in the tourism industry, such as hotels, lodges, or tour operators, can be a profitable venture. With the right marketing strategies and exceptional customer service, the tourism sector can generate significant returns.

ZARA Game drive tourist SUV - Renewable Energy: Tanzania has abundant renewable energy resources, including solar, wind, and hydro power. Investing in renewable energy projects, such as solar farms or small-scale hydro plants, can contribute to both environmental sustainability and financial gains. The government’s focus on promoting renewable energy makes this sector particularly attractive.

- Manufacturing: Tanzania’s manufacturing sector is in a growth phase, driven by increasing domestic consumption and regional trade. Investing in manufacturing industries, such as food processing, textiles, or construction materials, can be a lucrative option. Consider leveraging the availability of raw materials and the growing demand for locally produced goods.

Factors to Consider When Investing with 5 Million Tanzanian Shillings

While 5 million Tanzanian shillings may not seem like a significant sum, it can still open up various investment opportunities. However, it is essential to consider certain factors before making your investment decisions.

- Risk Tolerance: Assess your risk tolerance level before investing. Higher-risk investments may offer greater returns but come with increased uncertainty. Determine your willingness to accept potential losses and align your investments accordingly.

- Investment Horizon: Define your investment horizon, whether it’s short-term or long-term. Different investment options have varying timeframes for potential returns. Consider your financial goals and the time you can commit to your investments.

- Diversification: Diversify your investment portfolio to spread the risk. Allocate your funds across different sectors or asset classes to minimize the impact of any potential downturns in specific industries.

- Research and Due Diligence: Thoroughly research potential investments and conduct due diligence. Understand the market dynamics, industry trends, and any regulatory or legal requirements before committing your funds.

- Professional Advice: Seek advice from financial experts or investment professionals. They can provide valuable insights and help you make informed decisions based on your financial goals and risk appetite.

By considering these factors and conducting proper analysis, you can optimize your investment strategy and increase your chances of success.

Investment Strategies for Maximizing Returns

Now that we have considered the important factors, let’s explore some investment strategies that can help maximize returns with 5 million Tanzanian shillings.

- Systematic Investment: Consider adopting a systematic investment plan (SIP) approach. This strategy involves regularly investing a fixed amount over time, regardless of market conditions. By investing consistently, you can take advantage of market fluctuations and potentially benefit from the power of compounding.

- Long-Term Investing: Take a long-term perspective when investing. While short-term market volatility may seem daunting, focusing on long-term trends can help smooth out fluctuations and generate substantial returns. Identify industries or sectors with long-term growth potential and invest accordingly.

- Portfolio Rebalancing: Regularly review and rebalance your investment portfolio. As market conditions change, certain investments may outperform or underperform. Rebalancing allows you to reallocate funds to maintain a diversified portfolio and capture potential gains.

- Investment in ETFs: Consider investing in exchange-traded funds (ETFs) to gain exposure to a broad range of assets. ETFs offer diversification and can be a cost-effective way to invest in multiple sectors or markets.

- Investment Clubs or Groups: Join investment clubs or groups to pool resources and share knowledge. Collaborating with like-minded investors can provide access to a wider range of investment opportunities and help mitigate risks.

By implementing these strategies, you can enhance the growth potential of your 5 million Tanzanian shillings and increase your chances of achieving your financial goals.

Risks and Challenges of Investing in Tanzania

As with any investment, there are risks and challenges associated with investing in Tanzania. It is essential to be aware of these factors and take appropriate measures to mitigate potential risks.

- Political and Regulatory Environment: Political stability and a conducive regulatory environment are crucial for a favorable investment climate. Stay updated on political developments and regulatory changes that may impact your investments.

- Currency Risk: Investing in Tanzania involves exposure to currency risk. Fluctuations in the Tanzanian shilling exchange rate can affect the value of your investments. Consider hedging strategies or diversifying into other currencies to minimize this risk.

- Infrastructure Constraints: Despite ongoing infrastructure development, Tanzania still faces challenges in terms of transportation, power supply, and logistics. These constraints can impact business operations and investment returns. Conduct thorough due diligence on infrastructure availability and reliability before investing.

- Market Volatility: Emerging markets like Tanzania can experience higher levels of market volatility compared to developed markets. Be prepared for short-term fluctuations in the value of your investments and maintain a long-term perspective.

- Economic Factors: Economic factors such as inflation, interest rates, and GDP growth can impact investment returns. Stay informed about macroeconomic indicators and their potential implications for your investments.

By carefully assessing and managing these risks, you can navigate the Tanzanian investment landscape with confidence and minimize potential downsides.

Resources for Researching Investment Opportunities in Tanzania

To make informed investment decisions, it is crucial to have access to reliable information and resources. Here are some resources that can help you research investment opportunities in Tanzania:

- Government Agencies: The Tanzania Investment Centre (TIC) and the Ministry of Industry and Trade provide valuable information on investment opportunities, regulations, and incentives for foreign investors.

- Financial Institutions: Local and international banks, as well as investment firms, can offer insights into the Tanzanian market and specific investment opportunities.

- Industry Associations: Industry associations and chambers of commerce in Tanzania can provide sector-specific information and networking opportunities.

- Research Reports: Look for research reports from reputable institutions or consultancies that provide analysis on the Tanzanian economy, industries, and investment trends.

- Online Platforms: Explore online platforms and websites dedicated to promoting investment opportunities in Tanzania. These platforms often provide comprehensive information and connect investors with potential projects.

By leveraging these resources, you can stay well-informed and identify promising investment opportunities in Tanzania.

Case Studies: Successful Investments with 5 Million Tanzanian Shillings

To inspire and provide practical insights, let’s explore a few case studies of successful investments made with 5 million Tanzanian shillings.

- Case Study 1: Real Estate: Mr. John invested 5 million Tanzanian shillings in purchasing a plot of land in a developing area of Dar es Salaam. Over the next five years, the land’s value appreciated significantly, and he sold it for a profit of 20 million Tanzanian shillings.

- Case Study 2: Agriculture: Ms. Sarah invested 5 million Tanzanian shillings in establishing a poultry farm. With proper management and market demand for poultry products, her farm generated steady profits, and she expanded her operations over time.

- Case Study 3: Manufacturing: Mr. Joseph invested 5 million Tanzanian shillings in a small-scale food processing unit. By leveraging local agricultural resources and capturing growing demand for processed food products, his business flourished, and he successfully scaled up his operations.

These case studies highlight the potential for significant returns on investment with careful planning, market research, and effective execution strategies. While individual results may vary, they demonstrate the possibilities that exist in the Tanzanian investment landscape.

Investment Options for Different Risk Appetites

Investment opportunities in Tanzania cater to various risk appetites. Here are some options based on different risk profiles:

- Conservative Investors: For conservative investors seeking stability and regular income, consider fixed-income investments such as government bonds or fixed deposit accounts. These options generally offer lower returns but are less volatile.

- Moderate Investors: Moderate investors can explore diversified portfolios comprising a mix of fixed-income instruments, blue-chip stocks, and real estate investments. This balanced approach aims to generate stable returns while offering potential for capital appreciation.

- Aggressive Investors: Aggressive investors willing to take higher risks can consider investing in growth-oriented sectors such as technology, renewable energy, or emerging industries. These investments may be more volatile but have the potential for substantial returns.

It is important to align your investment choices with your risk tolerance and financial goals to create a well-balanced portfolio.

Conclusion: Taking the First Steps towards Investing in Tanzania

Investing in Tanzania’s vibrant economy offers a plethora of opportunities to grow your wealth. Whether you have 5 million Tanzanian shillings or more, understanding the Tanzanian economy, conducting research, and considering your risk tolerance are essential steps towards successful investments.

By exploring different sectors such as real estate, tourism, renewable energy, and manufacturing, you can identify potential investment avenues. Implementing investment strategies, conducting due diligence, and staying informed about market trends will maximize your chances of achieving attractive returns.

Remember, investing involves risks, and it is important to consult with financial experts or investment professionals to make informed decisions. With careful planning and a well-diversified investment portfolio, you can unlock the potential of your 5 million Tanzanian shillings and embark on a profitable investment journey in Tanzania.

For more articles related to Financial Services in Tanzania, click here!