USD to Tanzanian Shilling Chart: Understanding Currency Trends and Making Informed Decisions

Are you interested in keeping track of currency trends and making informed decisions about foreign exchange? Look no further than the USD to Tanzanian Shilling chart. This powerful tool allows you to monitor the exchange rate between the United States Dollar (USD) and the Tanzanian Shilling (TZS).

By studying the USD to Tanzanian Shilling chart, you can gain valuable insights into the fluctuations and patterns of these two currencies. Whether you’re a traveler planning a trip to Tanzania or a business owner engaged in international trade, understanding currency trends is essential. With this knowledge, you’ll be able to make informed decisions about when to exchange your money or conduct financial transactions. Stay ahead of the curve by regularly checking the USD to Tanzanian Shilling chart and harness the power of accurate information to optimize your financial activities.

Why understanding currency trends is important

Understanding currency trends is crucial for various reasons. For travelers, it helps to determine the best time to exchange their money to get the maximum value. If you are planning a trip to Tanzania, monitoring the USD to Tanzanian Shilling chart will give you insights into whether the exchange rate is favorable or not. By exchanging your currency when the exchange rate is in your favor, you can get more Tanzanian Shillings for your dollars, allowing you to have a better experience during your trip.

For businesses engaged in international trade, currency trends play a significant role in determining the cost of imports and exports. Fluctuations in exchange rates can impact the profitability of transactions. By closely monitoring the USD to Tanzanian Shilling chart, businesses can make informed decisions about when to conduct transactions to optimize their profits. Understanding currency trends also helps businesses negotiate contracts and pricing with their international partners, ensuring that they are not at a disadvantage due to unfavorable exchange rates.

Factors influencing the USD to Tanzanian Shilling exchange rate

The exchange rate between the USD and Tanzanian Shilling is influenced by several factors. Economic indicators such as inflation rates, interest rates, and GDP growth play a significant role in determining the strength of a currency. When the US economy is performing well, with low inflation and high growth, the USD tends to strengthen against other currencies, including the Tanzanian Shilling. On the other hand, if the Tanzanian economy is booming, with high growth and low inflation, the Tanzanian Shilling may appreciate against the USD.

Political stability and geopolitical events also impact currency exchange rates. Uncertainty or instability in either the United States or Tanzania can lead to fluctuations in the USD to Tanzanian Shilling exchange rate. For example, if there is political unrest in Tanzania, investors may lose confidence in the country’s currency, leading to a depreciation of the Tanzanian Shilling.

Other factors such as trade balances, government policies, and market sentiment can also influence currency exchange rates. It is essential to consider these factors when analyzing the USD to Tanzanian Shilling chart to get a comprehensive understanding of the currency trends.

Historical trends and patterns in the USD to Tanzanian Shilling exchange rate

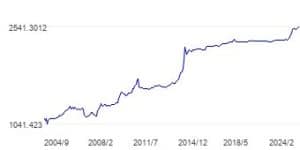

Analyzing historical trends and patterns in the USD to Tanzanian Shilling exchange rate can provide valuable insights for predicting future movements. Looking at the past performance of the exchange rate can help identify recurring patterns or trends that may indicate future movements.

For example, if historical data shows that the Tanzanian Shilling tends to weaken during certain months of the year, it may be advantageous to exchange your USD to Tanzanian Shillings before those months to take advantage of the higher exchange rate. Similarly, if historical data indicates that the Tanzanian Shilling tends to strengthen during certain periods, it may be wise to hold onto your USD and wait for a more favorable exchange rate.

Analyzing historical data can also help identify long-term trends in the USD to Tanzanian Shilling exchange rate. If the exchange rate has been consistently moving in a particular direction over an extended period, it may indicate a more significant underlying trend that can be useful for decision-making.

Analyzing current currency trends and forecasts

In addition to historical data, it is crucial to analyze current currency trends and forecasts to make informed decisions. Currency trends can change rapidly, and staying up-to-date with the latest information is essential.

Financial institutions and market analysts often provide forecasts and predictions for currency exchange rates. These forecasts are based on a variety of factors, including economic indicators, political events, and market sentiment. By studying these forecasts and comparing them to current trends in the USD to Tanzanian Shilling exchange rate, you can gain insights into potential future movements.

It is important to note that forecasts are not always accurate and should be used as a guide rather than a definitive prediction. However, they can still provide valuable information and help you make more informed decisions about your currency exchanges or financial transactions.

Tools and resources for tracking currency trends

Several tools and resources are available for tracking currency trends, including the USD to Tanzanian Shilling exchange rate. Online financial platforms and websites provide real-time and historical data on exchange rates, allowing you to analyze trends and patterns.

Currency converter apps and websites are also useful for quickly checking the current exchange rate between the USD and Tanzanian Shilling. These tools typically provide reliable and up-to-date information, helping you stay informed on the go.

Financial news and analysis websites are another valuable resource for tracking currency trends. These platforms provide insights from market experts, economic analysis, and updates on political and economic events that may impact exchange rates. By staying informed through these resources, you can make more educated decisions about your currency exchanges.

How to make informed decisions based on currency trends

Making informed decisions based on currency trends requires a combination of analysis, research, and risk management. Here are some tips to help you navigate the world of currency trading and make the most of currency trends:

- Stay informed: Regularly check the USD to Tanzanian Shilling chart and stay updated with the latest news and analysis related to currency trends. The more information you have, the better equipped you will be to make informed decisions.

- Set clear goals: Determine your objectives and establish a clear strategy for your currency exchanges. Are you looking to maximize your Tanzanian Shillings or minimize your costs? Setting clear goals will help guide your decision-making process.

- Diversify your portfolio: Consider diversifying your currency holdings to spread out your risk. Holding a mix of currencies can help protect you from potential losses if one currency depreciates significantly.

- Use risk management tools: Consider using risk management tools such as stop-loss orders or limit orders to protect yourself from adverse currency movements. These tools allow you to automatically execute trades when the exchange rate reaches a predetermined level.

- Seek professional advice: If you are new to currency trading or unsure about your decisions, consider seeking advice from a financial advisor or currency trading specialist. They can provide valuable insights and guidance based on their expertise.

By following these tips, you can navigate the currency markets with more confidence and make informed decisions based on currency trends.

Risks and challenges of currency trading

While currency trading can be profitable, it is essential to be aware of the risks and challenges involved. Currency markets are highly volatile and can be influenced by various factors, including economic events, political instability, and market sentiment. Fluctuations in exchange rates can result in significant gains or losses, depending on the direction of the movement.

Leverage is another factor to consider in currency trading. Many forex brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses, making risk management crucial.

Currency trading requires careful analysis and research. It is not a guaranteed way to make money, and even experienced traders can experience losses. It is important to approach currency trading with caution and only invest what you can afford to lose.

Tips for minimizing risks and maximizing gains in currency trading

While currency trading involves risks, there are several strategies you can employ to minimize risks and maximize gains:

- Educate yourself: Take the time to learn about currency markets, trading strategies, and risk management techniques. The more knowledge you have, the better equipped you will be to make informed decisions.

- Start with a demo account: Many forex brokers offer demo accounts that allow you to practice trading without risking real money. Use this opportunity to familiarize yourself with the trading platform and test your strategies before investing real capital.

- Develop a trading plan: Create a trading plan that outlines your goals, risk tolerance, and trading strategy. Stick to your plan and avoid making impulsive decisions based on emotions.

- Use stop-loss orders: Implementing stop-loss orders can help limit your losses by automatically closing your position if the market moves against you. This ensures that your losses are controlled and prevents significant drawdowns.

- Stay disciplined: Follow your trading plan and avoid chasing after quick gains or trying to recover losses too quickly. Emotions can cloud judgment and lead to impulsive decisions. Stay disciplined and stick to your trading strategy.

By following these tips, you can minimize risks and increase your chances of success in currency trading.

Using currency trends to your advantage

Understanding currency trends is essential for anyone involved in foreign exchange, whether you’re a traveler or a business owner engaged in international trade. By studying the USD to Tanzanian Shilling chart and analyzing currency trends, you can make informed decisions about when to exchange your money or conduct financial transactions.

Tracking currency trends allows you to take advantage of favorable exchange rates, ensuring that you get the most value for your money. It also helps businesses optimize their international trade activities by timing transactions to maximize profitability.

While currency trading involves risks, staying informed, setting clear goals, and using risk management tools can help minimize risks and increase your chances of success.

Harness the power of accurate information by regularly checking the USD to Tanzanian Shilling chart, staying updated with the latest news and analysis, and making informed decisions based on currency trends. Whether you’re an individual traveler or a business owner, understanding currency trends can make a significant difference in optimizing your financial activities.

For more articles related to Financial Services in Tanzania, click here!