Investor’s Guide: Understanding the Patterns and Trends of Tanzania Breweries Limited Share Price

Are you an investor looking to make informed decisions in the stock market? Look no further! In this investor’s guide, we will delve into the patterns and trends of the Tanzania Breweries Limited share price, providing you with valuable insights to help you navigate the market with confidence. TBL, a leading beverage company in Tanzania, has witnessed significant fluctuations in its share price over the years, influenced by various factors such as industry trends, financial performance, and market sentiments. By understanding these patterns, you can identify potential entry and exit points, optimize your investment strategies, and maximize returns. Join us as we analyze historical data, explore market indicators, and uncover the key drivers behind TBL’s share price movements. Whether you’re a seasoned investor or just beginning your journey, this comprehensive guide will equip you with the knowledge and tools necessary to make well-informed investment decisions in Tanzania’s dynamic brewing industry.

Basics of Share Prices and Stock Market Trends

Before diving into the patterns and trends of the Tanzania Breweries Limited share price, it’s essential to understand the basics of share prices and stock market trends. Share prices represent the value at which a company’s stock is traded on the stock market. They are influenced by various factors, including the company’s financial performance, industry trends, market sentiment, and macroeconomic conditions. Stock market trends refer to the general direction in which share prices are moving, either up (bullish) or down (bearish). These trends are driven by a combination of factors, including investor sentiment, economic indicators, and company-specific news and events.

To make informed investment decisions, it is crucial to analyze share price patterns and trends. By studying historical data and market indicators, investors can identify recurring patterns and gain insights into the potential future movements of share prices. This analysis can help investors determine the best time to buy or sell stocks, manage their risk exposure, and optimize their investment strategies. Now, let’s explore why understanding share price patterns and trends is important for investors.

Why Understanding Share Price Patterns and Trends is Important for Investors

Understanding share price patterns and trends is essential for investors for several reasons. Firstly, it allows investors to identify potential entry and exit points for their investments. By analyzing historical data and market indicators, investors can identify patterns that indicate when a stock may be undervalued or overvalued. This information can help investors make well-timed buying or selling decisions to maximize their returns.

Secondly, understanding share price patterns and trends enables investors to manage their risk exposure effectively. By studying the historical volatility and price movements of a stock, investors can assess the potential downside risks and set appropriate stop-loss levels. This risk management approach helps investors protect their capital and avoid significant losses in turbulent market conditions.

Lastly, analyzing share price patterns and trends provides investors with insights into the underlying factors driving a stock’s performance. By understanding the key drivers behind share price movements, such as industry trends, financial performance, and market sentiments, investors can make informed decisions based on fundamental analysis. This comprehensive view of a company’s prospects allows investors to make investment decisions that are aligned with their investment goals and risk tolerance.

Now that we understand why understanding share price patterns and trends is important, let’s explore the specific factors that influence TBL’s share prices.

Factors That Influence TBL Share Prices

The Tanzania Breweries Limited share price is influenced by a variety of factors, both internal and external. Understanding these factors can help investors gain insights into the potential movements of TBL’s share prices and make more informed investment decisions.

- Industry trends: TBL operates in the dynamic brewing industry, which is influenced by changing consumer preferences, economic conditions, and regulatory policies. Industry trends, such as shifts in consumer demand for certain types of beverages or changes in government regulations, can have a significant impact on TBL’s share prices. Monitoring industry trends and staying updated on market dynamics is crucial for investors to anticipate potential opportunities and risks.

- Financial performance: TBL’s financial performance, including its revenue, profit margins, and earnings growth, is a key driver of its share prices. Positive financial results, such as increased sales and profitability, generally lead to higher share prices, while negative financial performance can result in share price declines. Investors should analyze TBL’s financial statements, including its income statement, balance sheet, and cash flow statement, to assess the company’s financial health and growth prospects.

- Market sentiments: Investor sentiment and market perceptions play a vital role in influencing TBL’s share prices. Positive news or market expectations about the company, such as new product launches, expansion plans, or strategic partnerships, can drive share prices higher. On the other hand, negative news, such as product recalls, regulatory issues, or economic downturns, can lead to share price declines. Monitoring market sentiments and staying informed about the latest news and developments related to TBL is crucial for investors to make timely investment decisions.

Now that we have explored the factors that influence TBL’s share prices, let’s dive into a historical analysis of TBL’s share prices to identify common patterns and trends.

Historical Analysis of TBL Share Prices

Analyzing the historical data of the Tanzania Breweries Limited share price can provide valuable insights into the patterns and trends of the stock. By studying the price movements over a specific period, investors can identify recurring patterns and gain insights into the potential future movements of TBL’s share prices.

To conduct a historical analysis of TBL’s share prices, investors can start by collecting and organizing the relevant data. This can include daily, weekly, or monthly share prices, as well as any additional data points such as trading volumes or market indices. Once the data is collected, investors can use various tools and techniques to analyze the data and identify patterns.

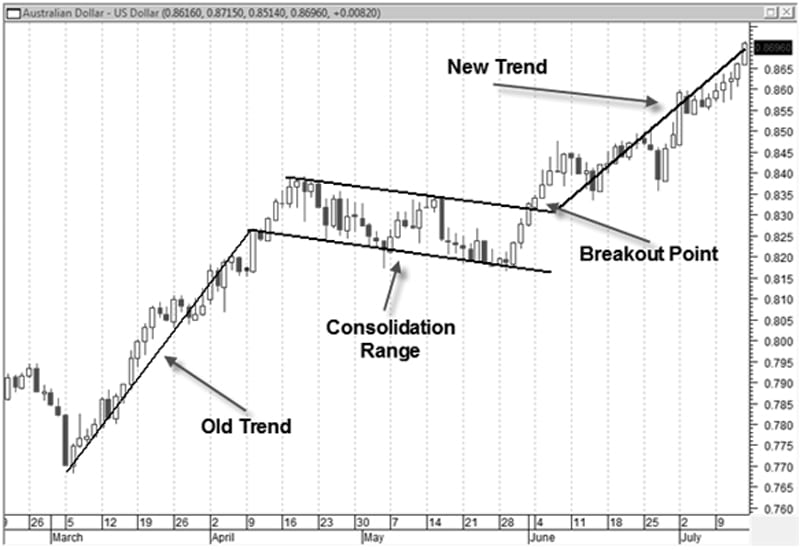

One common approach is to plot the share prices on a line chart and identify trends, such as upward or downward trends. This visual representation of the data can help investors identify support and resistance levels, which are price levels at which the stock has historically had difficulty moving above or below.

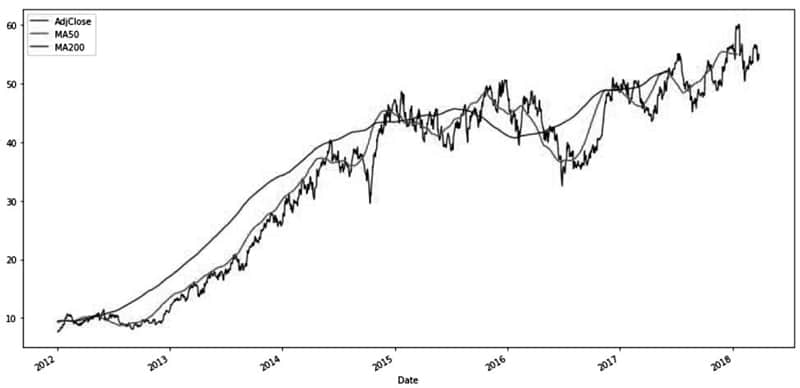

Another technique is to calculate key statistical measures, such as the average price, standard deviation, and correlation coefficients. These measures can provide insights into the volatility and overall trend of the stock. Investors can also calculate moving averages, which smooth out the price data and help identify longer-term trends.

By analyzing the historical data, investors can identify common patterns and trends in TBL’s share prices. These patterns can include uptrends, downtrends, consolidations, breakouts, and reversals. Understanding these patterns can help investors make more informed decisions, such as identifying potential entry or exit points for their investments.

Now that we have explored the historical analysis of TBL’s share prices, let’s discuss the tools and resources available for analyzing TBL share prices.

Tools and Resources for Analyzing TBL Share Prices

Analyzing the Tanzania Breweries Limited share price requires the use of various tools and resources. These tools can assist investors in conducting thorough analyses and gaining insights into the patterns and trends of the stock. Here are some commonly used tools and resources for analyzing TBL share prices:

- Financial websites: Financial websites, such as Bloomberg, Yahoo Finance, or Investing.com, provide a wealth of information and tools for analyzing share prices. These websites offer historical price charts, key financial ratios, analyst reports, and news updates related to TBL. Investors can utilize these resources to conduct technical analysis, and fundamental analysis, and stay updated on the latest market developments.

Bloomberg Logo - Charting platforms: Charting platforms, such as TradingView or MetaTrader, provide advanced charting tools and indicators for analyzing share prices. These platforms allow investors to customize their charts, overlay technical indicators, and perform in-depth analysis of TBL’s share prices. Investors can use various technical indicators, such as moving averages, relative strength index (RSI), or Bollinger Bands, to identify trends, support and resistance levels, and potential entry or exit points.

- Financial statements: TBL’s financial statements, including its annual reports, quarterly reports, and financial disclosures, provide valuable insights into the company’s financial performance and growth prospects. Investors can analyze these statements to assess TBL’s revenue, profitability, debt levels, and cash flow. By understanding the financial health of the company, investors can make more informed investment decisions.

- Market news and research reports: Staying updated on the latest market news and research reports related to TBL is crucial for investors. News articles, press releases, and research reports provide valuable information about TBL’s industry, competitors, market dynamics, and upcoming events. Investors can leverage this information to analyze TBL’s share prices in the context of broader market trends and make well-informed investment decisions.

Now that we have explored the tools and resources available for analyzing TBL share prices, let’s discuss some tips for interpreting share price patterns and trends.

Tips for Interpreting Share Price Patterns and Trends

Interpreting share price patterns and trends can be complex, but with the right approach, investors can gain valuable insights into the potential movements of a stock. Here are some tips for interpreting share price patterns and trends:

- Combine technical and fundamental analysis: To gain a comprehensive understanding of share price patterns and trends, investors should combine both technical and fundamental analysis. Technical analysis involves studying the historical price and volume data to identify patterns and trends, while fundamental analysis focuses on analyzing the underlying financial and qualitative factors that drive a stock’s performance. By combining these approaches, investors can make more informed investment decisions.

- Consider the broader market context: Share price patterns and trends should be interpreted in the context of broader market trends and economic conditions. Factors such as interest rates, inflation, geopolitical events, and overall market sentiment can influence the performance of individual stocks. Investors should consider these macroeconomic factors when analyzing share price patterns and trends to gain a holistic view of the stock’s potential movements.

- Be aware of market manipulation: Share price patterns and trends can sometimes be influenced by market manipulation or speculative activities. It’s essential for investors to be aware of such activities and differentiate them from genuine market trends. Conducting thorough research, relying on credible sources, and consulting with experienced investors or financial advisors can help investors navigate through potential market manipulations.

- Diversify your portfolio: Share price patterns and trends can vary across different stocks and sectors. It’s important for investors to diversify their portfolios by investing in a mix of stocks from various industries. Diversification helps mitigate the risks associated with individual stock movements and provides a more balanced investment approach.

By following these tips, investors can gain a deeper understanding of share price patterns and trends, enabling them to make more informed investment decisions and minimize potential risks.

Long-term vs. Short-term Investment Strategies for TBL Shares

When it comes to investing in TBL shares, investors can adopt either a long-term or a short-term investment strategy, depending on their investment goals, risk tolerance, and time horizon. Let’s explore the characteristics of each strategy:

- Long-term investment strategy: A long-term investment strategy involves holding TBL shares for an extended period, typically several years or more. Long-term investors focus on the company’s fundamental strength, growth prospects, and long-term value creation. They aim to benefit from the stock’s capital appreciation and potentially earn dividends over time. Long-term investors are less concerned about short-term price fluctuations and focus on the company’s long-term potential.

- Short-term investment strategy: A short-term investment strategy involves buying and selling TBL shares within a relatively short time frame, typically ranging from a few days to a few months. Short-term investors, also known as traders, aim to profit from short-term price movements and market inefficiencies. They rely on technical analysis, market indicators, and trading strategies to identify short-term trading opportunities. Short-term investors should be prepared to closely monitor market conditions, as short-term trading requires active involvement and quick decision-making.

Both long-term and short-term investment strategies have their pros and cons. Long-term investing provides the opportunity for compounding returns, reduces the impact of short-term market volatility, and aligns with a buy-and-hold approach. On the other hand, short-term trading offers the potential for quick profits, allows for more frequent portfolio adjustments, and takes advantage of short-term market inefficiencies. However, short-term trading requires active involvement, carries higher transaction costs, and poses greater risks.

Investors should carefully consider their investment goals, risk tolerance, and time horizon when choosing between a long-term or short-term investment strategy for TBL shares. It’s important to align the chosen strategy with one’s financial objectives and investment preferences.

Conclusion: Making Informed investment decisions with share price patterns and trends

Understanding the patterns and trends of the Tanzania Breweries Limited share price is crucial for investors looking to make informed investment decisions in the stock market. By analyzing historical data, exploring market indicators, and understanding the key drivers behind share price movements, investors can gain valuable insights into the potential movements of TBL’s share prices. This knowledge allows investors to identify potential entry and exit points, optimize their investment strategies, and maximize returns.

Throughout this comprehensive guide, we have explored the basics of share prices and stock market trends, discussed why understanding share price patterns and trends is important for investors, identified the factors that influence TBL’s share prices, conducted a historical analysis of TBL share prices, discussed tools and resources for analyzing TBL share prices, provided tips for interpreting share price patterns and trends, and discussed long-term vs. short-term investment strategies for TBL shares.

Whether you’re a seasoned investor or just beginning your investment journey, the insights and knowledge gained from analyzing share price patterns and trends can significantly enhance your decision-making process. By combining technical and fundamental analysis, considering the broader market context, and diversifying your portfolio, you can navigate the dynamic brewing industry in Tanzania with confidence and make well-informed investment decisions.

For more articles related to popular drinks in Tanzania, click here!