Banking Sector in Tanzania – Liberalization, Performances, Consolidation, Network and More

Banking Sector in Tanzania earned TZS 590 billion in profit before tax in 2019, an 88% increase from TZS 313 billion in 2018.

Tanzania had 48 licensed banks by August 2021: 35 commercial banks, five community banks, four microfinance banks, two mortgage banks, as well as two development banks.

Total Tanzania banking sector assets peaked at Tsh 33 trillion in 2019, up 9% from Tsh 30 trillion recorded in 2018.

Liberalization of the Banking Sector in Tanzania

Tanzania banking industry started on a financial liberalization strategy in the 1990s to boost the country’s economic growth.

This has been done through mobilizing financial resources, strengthening competition in financial markets, and improving the efficiency and quality of loan allocation.

As a result, the market has seen the entry of new commercial banks, merchant banks, credit bureaus, and bureaus de change, among other financial organizations.

Performance of the Tanzania’s Banking Sector

The banking sector earned 590 billion Tanzanian Shillings in profit before tax in 2019, a rise of 88% from 313 billion Tanzanian Shillings in 2018.

Total Tanzania banking sector assets reached 33 trillion Tanzanian Shillings in 2019, a 9% increase from 30 trillion Tanzanian Shillings in 2018.

Overdrafts and Loan advances (54%), debt securities (16%), and a balance with the Bank of Tanzania (8%) were significant elements of banking industry assets.

Personal loans (29 per cent), commerce (16 per cent), construction, real estate and building (11 per cent), manufacturing (10 per cent), agriculture, forestry, hunting and fishing (10 per cent), communication and transport (5 per cent), as well as other sectors (19 per cent) comprised the loan portfolio.

Total liabilities increased by 9% in 2019, rising from 25.7 trillion Tanzanian Shillings in 2018 up to 28.1 trillion Tanzanian Shillings in 2019. Deposits constituted 77 per cent of total bank liabilities.

Total capital rose by 8 per cent from 4.7 trillion TZS in 2018 to 5 trillion TZS in 2019.

This growth was ascribed to an increase in bank profitability over time.

Consolidation of the Banking Sector in Tanzania

In 2019, Tanzania had 51 licensed banks, including 38 commercial banks, six community banks, five microfinance institutions, and two development banks.

Mwanga Community Bank (MCBL), EFC Microfinance Bank and Hakika Microfinance Bank (HK MFB) merged in mid-2020, reducing the number of banks to 49. Mwanga Hakika Microfinance Bank, the resulting bank, was approved in July 2020. (MHB).

That same month, the BoT put CCB – China Commercial Bank Ltd under statutory administration and transferred all of its liabilities and assets to NMB Bank in March 2021.

The National Bank of Malawi (NBM) plc also acquired a 51 per cent controlling share in Akiba Commercial Bank in March 2021.

Banking Sector in Tanzania had 48 Banks Functioning by August 2021

“In my opinion, consolidation is normal in any sector since there will always be losers and winners,” said Kevin Wingfield, the CEO of Stanbic Bank Tanzania, a top lender in the country. “Given the present COVID-19 issues, I believe this will be emphasized, as the firms that respond quickly and adapt to remain relevant to the consumers will thrive, while the slower ones and those unable to change will be taken over or disappear.”

Tanzania Banking System

In 2019, Tanzania’s financial institutions had 957 branches, up from 878 back in 2018.

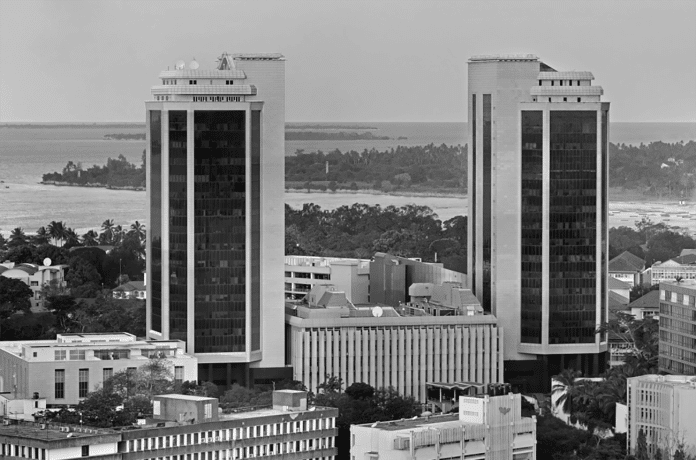

The majority of these branches were in Dar es Salaam, Mwanza, Arusha, Dodoma, and Moshi.

Dar es Salaam had up to 290 branches, accounting for 30.3 per cent of all branches, then Arusha with 68 branches (7.1 per cent), Mwanza with 67 branches (7 per cent), Moshi with 46 branches (4.8 per cent), and Dodoma with 41 branches (4.3 per cent).

The BoT issued comprehensive guidelines for agent banking in 2013, allowing financial institutions and regulated banks to designate retail agents to provide banking services.

This creates a way for banks to financially extend their services to lower-income people previously unbanked.

The total number of banking agents increased by 51% in 2019, from 18,827 in 2018 to 28,358 in 2019.

Prospects in the Tanzania Banking Sector

For a complete review of Tanzania’s banking sector, including how it is dealing with the Covid-19 epidemic as well as the consolidation that is going on. Check their Report on the Banking Sector in Tanzania.