CRDB Bank – Background, Locations, Internet Banking, SIM and More

CRDB Bank Plc Tanzania is among the commercial banks licensed and regulated by the Bank of Tanzania. By 31 December 2018, CRDB bank had total assets worth TZS 6.0 Trillion with overall deposits worth TZS 4.7 Trillion.

Background of CRDB Bank Tanzania

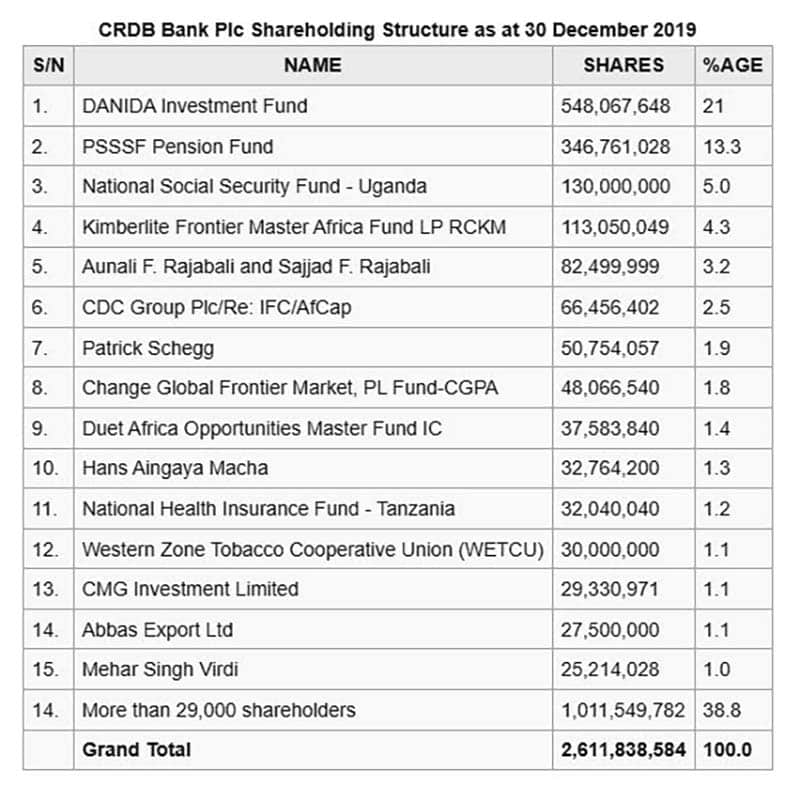

It is the biggest bank under private ownership in Tanzania. The bank was established in 1996 after the government of Tanzania privatized state-owned financial firms. Its biggest shareholders include Tanzania’s pension fund and a fund sponsored by the government of Denmark.

In 2009, CRDB bank listed its shares on the Dar es Salaam Stock Exchange (DSE) and by December 2019 the bank had more than30, 000 shareholders.

CRDB Tanzania Locations

The bank’s main branch and headquarters are located in the CRDB Bank Building on the 3rd Floor, along Azikiwe Street, Dar es Salaam, the country’s largest city and financial capital. The geographical coordinates of CRDB bank headquarters address are 39°17’15.5″E, 06°48’53.5″S, (Longitude: 39.287639; Latitude:-6.814861).

Ownership of the CRDB Bank Limited

The bank is a public listed company on the DSE owned by government institutions, individuals, and private firms with the shareholding structure below;

The shareholders were 30,023 before the last days of 2019.

CRDB Bank Subsidiaries, Operating Network and Structure

The CRDB Bank conglomerate comprises of 3 subsidiaries including CRDB Insurance broker offering various insurance products and/or services, CRDB Microfinance Ltd – a Microcredit business, and CRDB Bank Burundi Ltd, its first subsidiary overseas in Burundi as part of the expansion plan in the East African region.

In Tanzania, CRDB Bank owns 234 branches, with 535 CRDB ATM machines (scattered countrywide), 490 microcredit partners’ institutions, 15 mobile

CRDB branches, more than 1,500 merchants having sales terminals (PoS), more than 8,000 CRDB Wakala, mobile and internet banking services.

Financial Standing

Many international financial organizations such as KFW-DBG Germany, African Development Bank, International Financial Corporation (IFC), and CDC-UK have selected CRDB Bank as a friendly partner.

In 2016, the bank became the first one in Tanzania to join the list of the top 10 safe and stable African banks to invest in by Moody’s Investors Services, an international financial rating company. According to Moody’s, CRDB Bank deserved a “B1 stable outlook” — the best rating ever acquired by any financial institution or bank in sub-Saharan Africa.

By 2018, CRDB Bank’s balance sheet showed total assets worth TZS 6.0 trillion with total deposits worth TZS 4.7 trillion by 31 December 2018. CRDB handles leading financial investment transactions in Burundi and Tanzania and has about 3,100 employees.

Frequent Asked Questions

CRDB Bank Exchange Rate:

CRDB exchange rate today – https://crdbbank.co.tz/exchange-rates/

CRDB stock price – for details about CRDB share price, consult the following link:

https://www.marketwatch.com/investing/stock/crdb?countrycode=tz

CRDB PLC Loans and Daily Banking

CRDB bank loans – https://crdbbank.co.tz/jiachie-personal-loans/

CRDB mortgage loans – https://crdbbank.co.tz/jijenge-loan/

CRDB account opening requirements – https://crdbbank.co.tz/current-account/

Simbanking CRDB (CRDB sim banking) – https://crdbbank.co.tz/simbanking-app/

CRDB Customer Care:

CRDB bank customer care number:

+255(22)2197700

+255(0)714197700

+255(0)755197700

+255(0)789197700

CRDB Internet Banking Login and App:

Here are links to some of the critical CRDB bank internet banking related issues:

https://crdbbank.co.tz/internet-banking/

CRDB bank login – Checkout the following link to learn steps involved with the CRDB online banking login process https://omnichannels.crdbbank.co.tz/netteller-war/

CRDB app – The CRDB bank app has made most of the CRDB online banking needs easier and faster to any CRDB client with a smartphone in the country.

CRDB Bank Code Options:

CRDB bank swift code / IBAN number CRDB Tanzania: The CRDB bank Tanzania swift code to use when setting up your wire payment receipts (direct deposits) and other money wiring needs is CORUTZTZ. For branch specific CRDB swift code, please check out this CRDB bank branch codes page:

https://www.bank-codes.com/tanzania/branches-of-crdb-bank-limited

CRDB routing number – The main CRDB bank routing number is CORUTZTZ-

CRDB Jobs

https://crdbbank.co.tz/career/

CRDB Bank Contacts

Most Popular CRDB Bank Branches Contacts

CRDB Bank Burundi

Mailing Address:

P.O. BOX 254,

Bujumbura, Burundi

CRDB Bank Dar es salaam

- CRDB Azikiwe branch:

Noor Manzil Building, 759/10 Azikiwe St, Dar es Salaam 11104, Tanzania

- CRDB Mlimani City:

Sam Nujoma Rd, Dar es Salaam, Tanzania

- Meru CRDB Arusha Branch

Boma Road, Arusha, Tanzania

Headquarters CRDB Bank Address (The Main CRDB Bank PLC Address)

CRDB Bank in Dar es salaam

Azikiwe Street, CRDB Bank Headquarters, 3rd Floor

For more articles related to Financial Services in Tanzania (Money) click here!