Navigating the Tanzanian Financial Landscape: Understanding the Closed Currency System and the Tanzanian Shilling

Are you planning a trip to Tanzania? Before you go, it’s important to understand the country’s financial landscape, especially the Tanzanian Shilling closed currency system and the role of the Tanzanian Shilling. In this article, we will delve into the intricacies of Tanzania’s unique currency regulations and explore how they can impact your travel experience.

Overview of the closed currency system in Tanzania

Tanzania operates under a closed currency system, which means that the Tanzanian Shilling (TZS) cannot be freely exchanged outside the country’s borders. This can pose challenges for travelers who are used to using their own currency or widely accepted global currencies like the US Dollar or Euro.

The Tanzanian Shilling closed currency system is a measure put in place by the Tanzanian government to maintain control over the country’s economy and prevent capital flight. While it may seem restrictive, it has its benefits in terms of stabilizing the local currency and promoting economic growth. However, for travelers, it means that you will need to acquire Tanzanian Shillings for your expenses within the country.

Understanding the Tanzanian Shilling

The Tanzanian Shilling (TZS) is the official currency of Tanzania. It is issued and regulated by the Bank of Tanzania, the country’s central bank. The currency is denoted by the symbol “TSh” and is divided into 100 cents.

The Tanzanian Shilling is available in various denominations, including coins and banknotes. Coins are available in denominations of 50 cents, 100 cents, 200 cents, and 500 cents, while banknotes come in denominations of 500, 1000, 2000, 5000, and 10,000 Tanzanian Shillings.

It’s important to note that the Tanzanian Shilling is the only legal tender for transactions within the country. While some establishments may accept foreign currencies, especially in popular tourist areas, it is always advisable to have the local currency on hand for convenience and to avoid any potential issues.

Exchange rates and foreign currency transactions in Tanzania

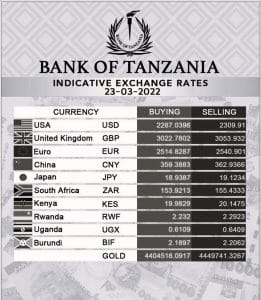

As a result of the Tanzanian Shilling closed currency system, the exchange rates for foreign currencies in Tanzania can vary. The Tanzanian Shilling’s exchange rate is primarily determined by supply and demand factors within the country.

To get the best exchange rates, it’s recommended to exchange your currency at authorized exchange bureaus or banks. These institutions are regulated and offer competitive rates compared to other sources. Avoid exchanging currency with street vendors or unauthorized individuals, as they may offer unfavorable rates or engage in fraudulent activities.

When exchanging currency, it’s important to compare rates and fees to ensure you are getting a fair deal. Some exchange bureaus may charge a commission or have additional fees, so be sure to inquire about these before proceeding with the transaction. Additionally, keep an eye on the daily exchange rates as they can fluctuate, and timing your currency exchange can make a difference in the amount you receive.

Challenges and benefits of the closed currency system

The closed currency system in Tanzania can present both challenges and benefits for travelers. On the one hand, it requires visitors to obtain Tanzanian Shillings for their expenses, which may involve additional steps and potential fees for currency exchange. This can be an inconvenience, especially for those who prefer to use their own currency or widely accepted global currencies.

However, the Tanzanian Shilling closed currency system also has its advantages. By using the Tanzanian Shilling, you support the local economy and contribute to its stability. It also provides an opportunity to immerse yourself in the local culture and gain a better understanding of the country’s financial landscape.

Additionally, the closed currency system helps protect the Tanzanian economy from external currency fluctuations and speculative activities, which can lead to economic instability. It allows the government to have more control over monetary policies and ensure a more stable financial environment for both locals and visitors.

How to exchange currency in Tanzania

To exchange currency in Tanzania, you have several options. The most common method is to visit authorized exchange bureaus or banks. These establishments are widely available in major cities and tourist areas. They offer competitive rates and are regulated by the government, ensuring a safe and reliable currency exchange process.

Before visiting an exchange bureau or bank, it’s a good idea to research their reputation and compare rates. Look for establishments that have positive reviews, transparent fees, and a good track record of customer satisfaction. This will help ensure a smooth and trustworthy currency exchange experience.

Another option for currency exchange is through ATMs. Most major cities in Tanzania have ATMs that accept international cards. However, it’s important to check with your bank or card issuer regarding any fees or restrictions that may apply to international withdrawals. Additionally, inform your bank about your travel plans to avoid any potential issues with your card being flagged for suspicious activity.

Banking and financial services in Tanzania

In addition to currency exchange services, Tanzania offers a range of banking and financial services for both locals and visitors. Major cities have well-established banks that provide a variety of services, including savings and checking accounts, money transfers, and loans.

When choosing a bank in Tanzania, consider factors such as reputation, accessibility, and customer service. Look for banks that have a wide network of branches and ATMs, as well as convenient online or mobile banking options. This will ensure that you have access to your funds and can easily manage your finances during your stay in Tanzania.

It’s also advisable to notify your bank about your travel plans to avoid any issues with your accounts or cards. Inform them about the duration of your stay and provide contact information in case they need to reach you while you’re abroad. This proactive step can help prevent any unnecessary complications with your banking services.

Investing in Tanzania: Opportunities and considerations

For those interested in long-term financial considerations, Tanzania offers various investment opportunities. The country has a growing economy and is attracting foreign investment in sectors such as agriculture, energy, tourism, and infrastructure development.

Before considering any investment in Tanzania, it’s important to conduct thorough research and seek professional advice. Familiarize yourself with the legal and regulatory framework, as well as any tax implications that may apply to foreign investors. Additionally, consider factors such as market trends, political stability, and economic indicators to make informed investment decisions.

Tanzania has a well-established capital market, with the Dar es Salaam Stock Exchange (DSE) serving as the primary platform for trading securities. If you are considering investing in the Tanzanian stock market, consult with a licensed stockbroker who can guide you through the process and help you navigate the local investment landscape.

Tips for managing finances in Tanzania

To ensure a smooth financial experience during your time in Tanzania, here are some additional tips for managing your finances:

- Carry a mix of cash and cards: While the Tanzanian Shilling is the preferred currency for transactions, it’s always a good idea to have a mix of cash and cards for flexibility. Major credit and debit cards are accepted in some establishments, especially in urban areas and tourist destinations. However, be prepared for instances where cash is the only accepted form of payment.

- Keep small denominations of Tanzanian Shillings: Having small denominations of the local currency can be useful for smaller purchases, tipping, or instances where change may be limited. It’s advisable to have a range of coins and smaller banknotes to avoid any inconvenience or potential issues with receiving change.

- Monitor your expenses: Keep track of your expenses and maintain a budget to ensure you stay within your financial means. This will help you make informed decisions and prevent overspending during your trip. Consider using mobile apps or budgeting tools to simplify the process and keep your finances organized.

- Be cautious with ATMs and card transactions: When using ATMs or making card transactions, be aware of your surroundings and take precautions to protect your personal and financial information. Avoid using ATMs in secluded or poorly lit areas, and shield your PIN when entering it. Regularly monitor your bank statements and report any suspicious transactions to your bank immediately.

- Keep emergency funds: It’s always a good idea to have emergency funds available in case of unforeseen circumstances. This can be in the form of cash or easily accessible funds in a separate account. Having a backup plan will provide peace of mind and ensure you are prepared for any financial emergencies that may arise during your trip.

Navigating the Tanzanian financial landscape

In conclusion, understanding the Tanzanian Shilling closed currency system and the role of the Tanzanian Shilling is essential for a smooth financial experience during your visit. By familiarizing yourself with the currency exchange process, local banking facilities, and other financial considerations, you’ll be better equipped to navigate the Tanzanian financial landscape.

Remember to research and compare rates when exchanging currency, choose reputable banking institutions, and notify your bank about your travel plans. Consider a mix of cash and cards for convenience, monitor your expenses, and keep emergency funds for peace of mind.

Tanzania offers unique investment opportunities for those interested in long-term financial considerations. However, it’s important to conduct thorough research and seek professional advice before making any investment decisions.

By following these tips and approaching your financial transactions with knowledge and preparedness, you can fully enjoy your time in Tanzania and make the most of your financial interactions in this beautiful East African nation.

For more articles related to Financial Services in Tanzania, click here!