Canara Bank Tanzania Limited – Profile, Products, Services and More

Canara Bank Tanzania Limited is a fully owned Canara Bank India subsidiary, one of India’s most well-known public sector banks. On May 9, 2016, the bank opened its doors in Dar es Salaam, Tanzania, with a paid-up capital of 32 billion Tanzanian Shillings, compared to the local statutory requirement of 15 billion TZS. They have made profits in their first two years of business in Tanzania.

They provide all the fundamental banking services, such as savings accounts, current accounts, fixed deposit accounts, recurring deposit accounts, overdrafts and loans for various purposes, remittances outside and within Tanzania, mobile apps, locker services, and so on.

Canara Bank Tanzania Ltd Shareholder Introduction

Canara Bank was established in July 1906 in Mangalore, then a tiny port town found in Karnataka, by Shri Ammembal Rao Pai Subba, a remarkable thinker, and philanthropist. Throughout its hundred-year history, Canara Bank has undergone different stages of growth. Canara Bank grew at a breakneck pace following nationalization in 1969, achieving national status in terms of clientele segments and geographic reach. Several significant milestones have marked the Bank’s long and eventful journey. Canara Bank is now one of India’s most well-known financial institutions. In addition to representative offices, joint and subsidiary ventures, the bank maintains offices in London, Moscow, Hong Kong, Shanghai, New York, Doha, Dubai, and Tanzania.

Canara Bank is one of India’s most prestigious financial institutions. The bank wishes to develop bilateral Indo-Tanzanian relations by providing a wide range of financial products and services to Tanzania’s corporate clientele and the general public through the Canara Bank Tanzania Limited.

Vision of Canara Bank Tanzania Ltd

To become a Preferred Bank by meeting or exceeding worldwide benchmarks in operational efficiency, profitability, asset quality, global reach, and risk management. Canara Bank Ltd (T) plans to expand its branch network and provide bank services to customers’ doorsteps in order to give the best financial services to the community.

Canara Bank Tanzania Ltd Mission

To deliver high-quality banking services with excellent customer service, to add value to all stakeholders, and to be a responsible corporate social citizen.

Canara Bank Tanzania Limited Products and Services

Savings Account

- Eligibility

Individuals, Minor Accounts under Guardian representation, Joint Account (Maximum of 4), Trusts, Government Bodies, Administrators and executors, Recognized Pension Funds, Societies, Schools, Non-Corporate Bodies Viz Clubs, Associations, etc

- Nature of Deposit

Running Account (Operative)

- Minimum Balances

Mean Monthly Balance of 20000 TZS Mean monthly balance of US$ 20

- Interest Rate

2.5 percent for TZS and 0.25 percent for US$ (Currently

- With Holding Taxes

Applicable will be deducted

- Periodicity of Payment of Interest

Interest is payable twice per annum, every June and December on the balance kept in the account daily

- Nomination

Available

- Application and Documents

2 photographs of the person depositing, Application in the form prescribed by the bank, Proof of Identity such as a Passport, National ID, Voter Registration Card, Driving Licence, and Address Proof according to KYC Norms

- Other Canara Bank Tanzania Limited Facilities

Standing Instructions, Nomination, Cheque Collection, EFT, Instance Remittance to India, TISS

Current Account

- Eligibility

Individuals, Proprietorship, Joint Account (maximum of 4), Partnership, Trust, Company, Association or any Institution.

- Special Accounts

Accounts of Redcross Society/ School, Provident Fund, Post Office Accounts, Accounts for interest warrants/dividend Issue

- Minimum Balances

100,000 TZS and 100 USD

- Interest Rates

No Interests

- Periodicity of Deposit

Running Account (operative)

- Nomination Facility

Individual Accounts, Proprietorship accounts, Joint accounts. ** Unavailable to accounts held in partnerships, representative capacityviz, Joint Stock Companies, Clubs, Associations and other organizations

- Application and Documents

Authorised signatories/ photographs of account holders (Two copies), Application in the form prescribed by the bank, Certificate of Incorporation, Articles of Association and Memorandum, Board Resolution, Certificate of registration and Partnership deed (Where applicable)

- Other Facilities

Standing Instructions, Pay sheet, Collection of outstation and local cheques (at account holder’s cost), TISS, EFT, Foreign remittances and so forth.

Canara Bank Tanzania Limited; Fixed Deposit

- Eligibility

Individuals, Minor Accounts under Guardian representation, Joint Account (Maximum of 4), Trusts, Proprietorship, Company, Partnership, Associations, etc

- Period of Deposit

Maximum of 120 Months, Minimum of three months

At least 500 USD or 1 million TZS, No maximum amount

- Interest Rate

Depending on the period of Deposit varies

- WHT on Interest

Deducted as applicable

- Nomination

Available

- Premature Closure Penalty

Penalties are applied upon premature closure

- Application and Documents

2 photographs of the person depositing, Application in the form prescribed by the bank, Address and Proof of Identity according to KYC Norms. As well as any other associated documents as applicable to a partnership firm, a Proprietorship concern, company etc

- Deposit auto-renewal

Deposits shall be automatically renewed from the maturity date for the same period on the maturity date at the applicable interest rates for the period as on the maturity date, in the absence of preset renewal instructions.

Canara Bank Tanzania Limited; Recurring Deposits

- Eligibility

Individuals, Minor Accounts under Guardian representation, Joint Account (Maximum of 4), Trusts, Proprietorship, Partnership, Company, Associations, etc

- Period of Deposit

Six months minimum and 120 months maximum

- Pattern of Deposit

Minimum of 50,000 TZS monthly, no maximum. Fixed monthly installments over a given time

- Nomination

Available

- Interest Rate

According to the card Rate of the Bank

- Loan Facility

A maximum of 90 percent of the deposited amount

- With Holding Tax

Shall be deducted as applicable

- Application and Documents

Address and proof of identity according to KYC Norms, Depositor’s photograph, related documents applicable to proprietorship concerns, company, partnership firm, association, etc

- Penalty for Pre-Mature Closure

1.00% penalty shall be levied in case of premature closure

Canara Bank Tanzania Limited; Loans

Housing Loans

Purpose

- For the purpose of constructing a new residing unit.

- For the purchase of a new residing unit.

- For funding the acquisition of an older residential unit with a maximum loan term of 15 years if the house/flat is structurally sound.

- For the purpose of repairing, renovating, or extending an existing home.

- For the purpose of repaying a debt obtained from another institution.

Loan Amount

A maximum of TZS 500 million or its equivalent of foreign currency

Ceiling of Loan Amount

The amount loaned depends on enough net disposable income monthly.

Margin

- 20% for the construction or purchase of residential units. (Cost of land included)

- 25% for the repair, extension or renovation of existing residential unit

- 30% for the acquisition of an old residential unit

- 35% for the acquisition of a plot only.

Interest Rate

As applicable

Security

Legal property mortgage

A personal guarantee from one or more people with a combined net worth of twice the loan amount is required.

Repayment Schedule

- 15 years is the maximum payback duration (including a moratorium)

- Up to 20 years in deserving/ exceptional instances (including a moratorium)

- Equated Monthly Installments offers a repayment option (EMI)

Moratorium

18 months from the date of the first payout or the completion of the building project, whichever comes first.

Canara Bank Tanzania Limited; PROCESSING FEE:

Based on the card rate.

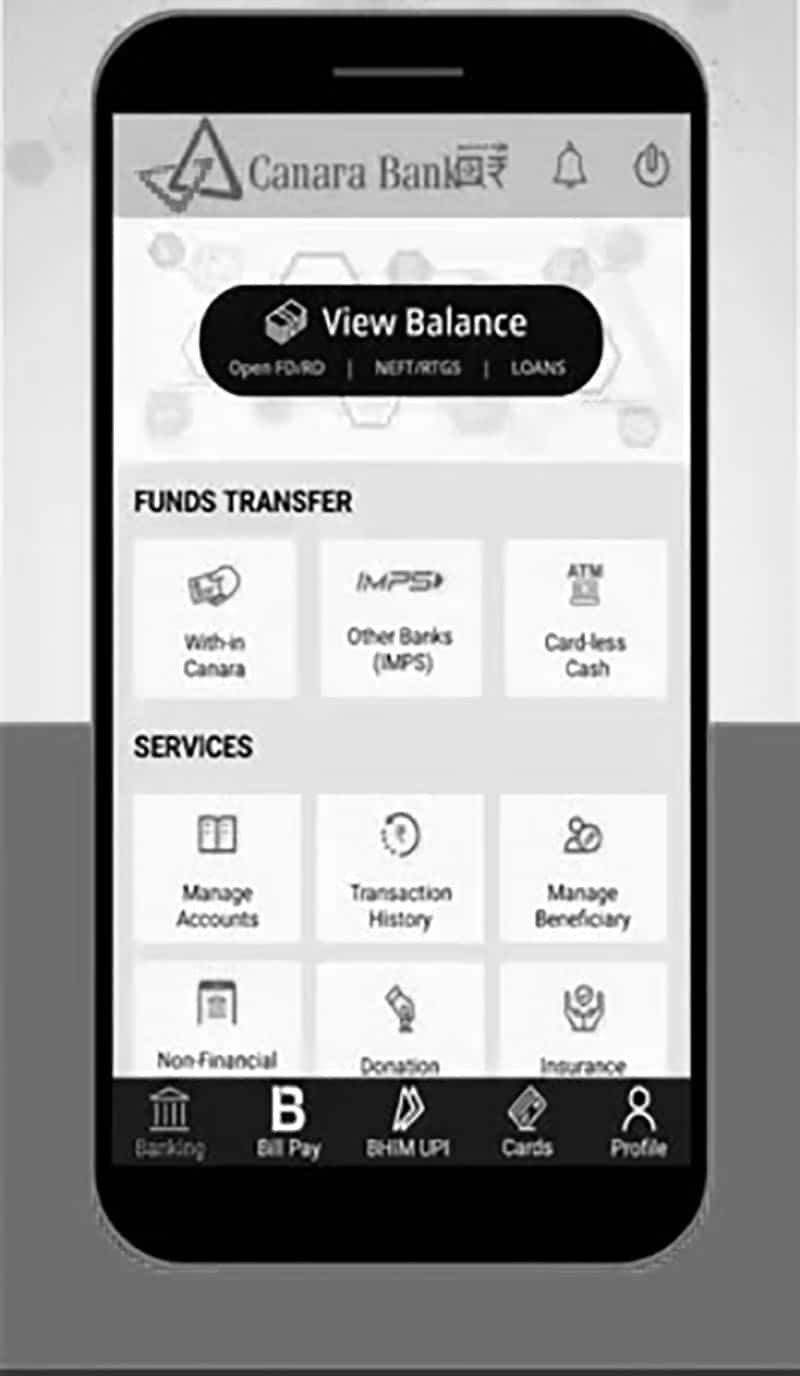

Making Banking Simple and Life Easier

Canara Bank has made the switch to digital banking. Customers no longer need to go to the bank or use their laptops; they simply need to download the mobile application to their phones and have access to their bank account data 24 hours a day, 7 days a week. Balance inquiry, funds transfer, mini statement, cellphone recharge, utility payment, and many other services are available.

Service Charges

| USD | TZS | D.REMITTANCEs | |||

| A SAVINGS BANK | USD | TZS | |||

| Non Maintenance of Minimum Balance | FREE | FREE | E Remittances | ||

| Monthly Maintenance Charges | FREE | FREE | TISS | $11.8 | 11,800 |

| A/C Statement Charges | Up to $1000 or TZS-equivalent | $10 | 20,000.00 | ||

| Intern | $5 | 5,000.00 | 5001 – 10000 | $25 | 48,000.00 |

| Monthly | FREE | FREE | $12 | 24,000.00 | |

| Cash withdrawal Fees | Free up to 5000

0.3% above 5000 |

FREE | 10,001 and over | $50 | 100,000.002 |

| Cash Deposit fees | FREE | FREE | SWIFT | ||

| Certificate of Balance confirmation | $7 | 15,000.00 | a) Swift outward | ||

| Account closure fees | $15 | 15,000.00 | Upto 5000 | $45 | NA |

| Dormant account activation | $6 | 6,000.00 | 5001 –10,000 | $460 | NA |

| B. Canara Bank Tanzania Limited; CURRENT ACCOUNT | Above 10,000 | $90 | NA | ||

| b) swift Inward | |||||

| Non Maintanance of Minimum Balance | FREE | FREE | 5,001-10,000 | $18 | NA |

| Monthly Maintanance Charges | FREE | FREE | Upto 5,000 | $12 | NA |

| Account Statement Charges

Intern Monthly |

$5+1 per page

$5 |

5000+500 per page

5000 |

0ver 10,000 | $30 | NA |

| Cash withdrawal fees | FREE UPTO 5000

O.3%- 5000-10,000 0.5%- OVER 10,000 |

FREE UPTO 50 MIO

0.12% ABOVE 50 MIO |

E. ADVANCES/LOANS RELATED CHARGES | ||

| Cash Deposit fees | FREE UPTO 10,000

0.3% OVER 10,000 |

FREE UPTO 50 MIO

0.12% ABOVE 50 MIO |

Inspection Charges | Upto 50,00- $25 >50,000-$50 | Below 100 Mio –25,000, above 100 mio – 50,000 |

| Certificate of Balance Confirmation | $15 | 25,000.00 | Upfront fee on Term Loan | Upto 20,000 – $300, 20,000 to 500,000 – 1.8 percent, >500,000 – 1.5 percent *minimum 9000 | Below 5 Mio – 25,000, 5 to 10 Mio – 200,000, 10 to 25 Mio – 450,000, 25 to 500 mio – 1.8 %, Above 500 mio – 1.5% *minimum 9 mio |

| Stop Payment fees | $15 | 30,000.00 | Documentation Charges | Below 50,000- nill, above 50,000 – 0.3 percent, min 150 | Below 100 mio- Nil, Above 100 Mio- 0.3%, min 300,000 |

| Cheque Clearing fees | Hon/Re | Hon/Ret | Processing Charges | Below 5,000- $100, 5000 – 10,000 – $200, Upto 20,000 – $300, 20,000 – 500,000 – 1.5%, over 500,000- 1.25% *minimum 7,500 | Below 5 Mio-25,000, 5 to 10 Mio – 200,000, 10 to 25 Mio –400,000, 25 to 500 mio- 1.5 percent, Above 500 Mio – 1.25 percent * minimum 7.5 mio |

| Outward | $1/$15 | 1500/30,000 | F. LETTER OF CREDIT | ||

| Inward | Free/$15 | Free/30,000 | Import Letter of Credit (per quater of part thereof) | ||

| Account closure charges | $20 | 25,000.00 | Opening commission | 1.2% (Minimum $200) | NA |

| C. Canara Bank Tanzania Limited; MOBILE BANKING CHARGE | LC amendment Commission | 0.4% (minimum $50 maximum 350) | NA | ||

| 1.Cash Withdrawal | Swift charge for LC opening | $40 | NA | ||

| Below 100,000 | NA | 2,000.00 | Swift charge for amendments/ other message | $40 | NA |

| 101,000 – 200,000 | NA | 3,000.00 | Extensions- Commision | 1.2% (minimum $200) | NA |

| 201,000 – 400,000 | NA | 5,000.00 | LC cancellation charges | 1.2% (minimum $200) | NA |

| 401,000 – 600,000 | NA | 6,000.00 | Non- payment of Bills on due date | 16 percent Till Payment | NA |

| 601,000 – 999,000 | NA | 8,000.00 | Credit Export Letters (per qtr or part thereof) | ||

| 2. Mobile Wallet/Funds Transfer | Amendments | NA | |||

| Below 100,000 | NA | 500.00 | Export LC collection | NA | |

| 101,000 – 250,000 | NA | 1,000.00 | Extensions – Commisions | NA | |

| 251,000 – 500,000 | NA | 2,000.00 | Reimbursement claim period | NA | |

| 501,000 – 1,000,000 | NA | 5,000.00 | Negotiating bills under LC | NA | |

| 1,001,000 – 10 Mn | NA | 10,000.00 | Confirmation Commission | NA | |

| Advising commission | NA | ||||

| Mobile Banking Services | G. Guarantees (Local and International) | ||||

| A) PIN Request | NA | 2,500.00 | Bonds and Guarantees | 1.2% | 1.2% (minimum TZS 75,000) |

| B) Monthly Subscription Fees | NA | 500.00 | Bonds and Guarantees with 100 percent cash margin | 40 percent of actual charges | 0.5 percent per quarter (Minimum TZS 75,000) |

| H. LOCKERS RENT YEARLY | CANARA BANK TANZANIA LIMITED

16/1, ZANAKI BIBI TITI STREET, ELIA COMPLEX POST BOX NO 491, TANZANIA’S DAR ES SALAAM TELEPHONE NO: 255 22 2112530/31/32/34 |

||||

| 1. SMALL | 350,000.OO | ||||

| 2. MEDIUM | 600,000.00 | ||||

| 3. BIG | 750,000.00 | ||||

International Banking Services

Canara Bank Tanzania Limited, a fully owned Canara Bank India subsidiary, began operations in Tanzania on May 9, 2016.

* They finance exports at both the pre-and post-shipment stages, in either local or foreign currency;

The Bank not only funds pre-shipment and post-shipment phases in foreign currency at the request of clients, but also finances the import leg in the foreign currency when imported materials are necessary for exports.

We specialize in non-fund operations such as adding confirmations to LCs, providing outbound and inward Bid bonds and guarantees, creating LCs for import into India, and arranging the buyer’s credit under favorable conditions. ** The aforesaid services are provided at a competitive price to the bank’s clients, subject to the exchange controls and the bank’s policies/provisions as established by the Regulatory Authorities from period to period. Canara branch maintains branches in New York, Bahrain, London, Leicester, Hong Kong, Johannesburg, Moscow, and Shanghai.

Remit Money to India

- Secured Transfer

- Marketing beating rats of exchange

- Affordable charges

- Hassle-free and faster remittance

- Web-centered remittance to India

Canara Bank of Tanzania Interest Rates

Interest rates on Term Deposits in TZS W.E.F 01.01.21

| Tenor/Period of Deposit | Below 50 Mio (%) | 50 – 100 Mio (%) | Over 100 Mio (%) |

| 30 –90 days | 3.5 | 4.5 | 5.5 |

| 91 – 180 days | 4.5 | 5.5 | 6.5 |

| 181 –364 days | 5.5 | 7.0 | 7.5 |

| Over 1 year | 8.0 | 8.25 | 8.5 |

In USD (Foreign currency)

| Tenor/Period of Deposit | Below 50,000 (%) | 50,000 – 100,000(%) | Over 100,000 (%) |

| 30 – 90 days | 1.5 | 2.25 | 2.5 |

| 91 –180 days | 2.0 | 2.75 | 3.25 |

| 181 – 364 days | 2.5 | 3.0 | 3.50 |

| Over 1 year | 3.0 | 3.5 | 4.0 |

Foreign Exchange (04.01.2022)

| Currency | SELLING RATE | BUYING RATE |

| USD to TZS (50”-100”) | 2,330.00 | 2,290.00 |

| INR to TZS | — | 73.48 |

| USD to INR | 31.71 | — |

NRI Services

The Canara Bank Tanzania Limited can help you create a free NRI account in your home town if you bring the necessary documentation with you.

- Two passport-sized photographs

- PAN Card

- Aadhar Card

- Resident Permit

- Work Permit

- Passport copy

For more articles related to Financial Services in Tanzania, click here!