Tanzania Revenue Authority TRA Forms That Can Be Completed Online as of December 2020

Completing Tasks Related to Taxes via the Internet

Performing and completing tasks through a built-in tax returns e-filing electronic submission system (E-filing).

You will be able to complete the following tasks:

1. Register as a tax returns e-filer (e-filer)

2. Appoint declarants to complete tax returns as representatives of an institution;

3. To appoint an auditing firm and auditors to verify income tax estimates prior before submitting it to the Tanzania Revenue Authority (TRA);

4. Submit tax returns;

5. Reviewing income tax returns;

6. Application to extend the time for submitting tax returns; and

7. Accessing and view submitted returns, evaluations and other related data.

Link to full form of TRA to submit tax returns online – https://efiling.tra.go.tz/

Online Auctions TRA Forms

It enables individuals, businesses, and other institutions to take part in auctions of goods that have been left by their owners due payment defaulting on custom duty.

Things that an individual must have in order to participate in these auctions is just a smart phone or any other types of electronic communication devices that can browse internet and log on to the TRA site which will provide the bidder with proper instructions about the auction.

“The objective of the Custom Online Auction is not to collect revenue, but to instead recover the revenue that the government would lose

on abandoned goods,” claimed Dr Mhede.

Link to TRA full form to submit tax returns online https://customs.tra.go.tz/um/bidder/auctionLink.do

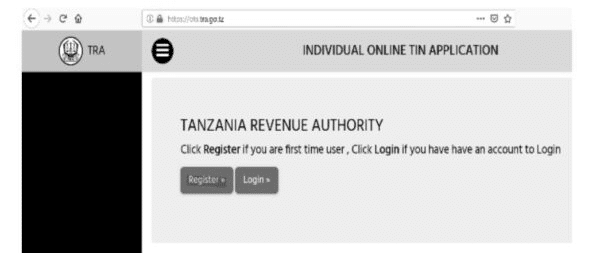

TRA Account Full Form for Updating or Registering TIN for Individuals

Organizations that are newly established can now register Taxpayer Identification Numbers (TIN) online. This online network system was launched by the Tanzania Revenue Authority (TRA) on August 6, 2020. The essence of this initiative is based on section 22 of the Tax Administration Act, (Cap 438 R.E 2019). The section of the Act calls on all taxpayers to ensure they do have a Taxpayer Identification Number (TIN).

Link to Tanzania Revenue Authority forms for personal application tin– https://ots.tra.go.tz/

TRA Forms to Register Payment(s)

The Tanzania Revenue Authority (TRA) has been working aggressively to make its operations modern by making its procedures automatic just as in the Third Corporate Plan. From this basis, TRA has launched an online form called ‘TISS order form’ . This is one of online TRA forms that will make it easier for taxpayers not only to obtain, fill out and print the form at their places of work but also to verify that all taxpayer-filled information gets to the appropriate TRA office and is stored properly. In addition, the taxpayer will be able to confirm the status of his or her payment online if it actually reached the TRA offices.

Link to TRA forms for payment registration – https://gateway.tra.go.tz/paymentregistration/Account/Login.aspx?ReturnUrl=%2fPaymentRegistration%2findex.aspx

TRA Tax Form to Submit Value Added Tax (VAT) Returns

This system has been built with the main target of simplifying the system of submitting tax returns for taxpayers. The system was designed and made operational to perform the following:

Be able to register on the system using Taxpayer Identification Number (TIN), Email and Address credentials. The Tanzania Revenue Authority (TRA) will then automatically provide an Electronic Identification Number once the registration process is complete. In the end, the taxpayer is provided his or her password via email. As a result, it will be possible for the taxpayer to make submissions of tax returns online.

Link to TRA forms for submitting VAT returns online – https://gateway.tra.go.tz/Efiling/login.aspx

Customs Licensing Management TRA Forms

Anyone who prefers to be a customs agent for importers and anyone who wants run any of these types of businesses; Container Freight Stations, Customs Bonded Warehouses, Inland Container Depots, Manufacture Under Bond facilities, and Transporters of Goods under Customs Control, are always welcome make applications to the Commissioner of Customs and Excise as long as they fulfill the General Terms and Conditions for the requested license type.

This can be done now through online TRA forms – https://customs.tra.go.tz/licenseManagement/login/login.do

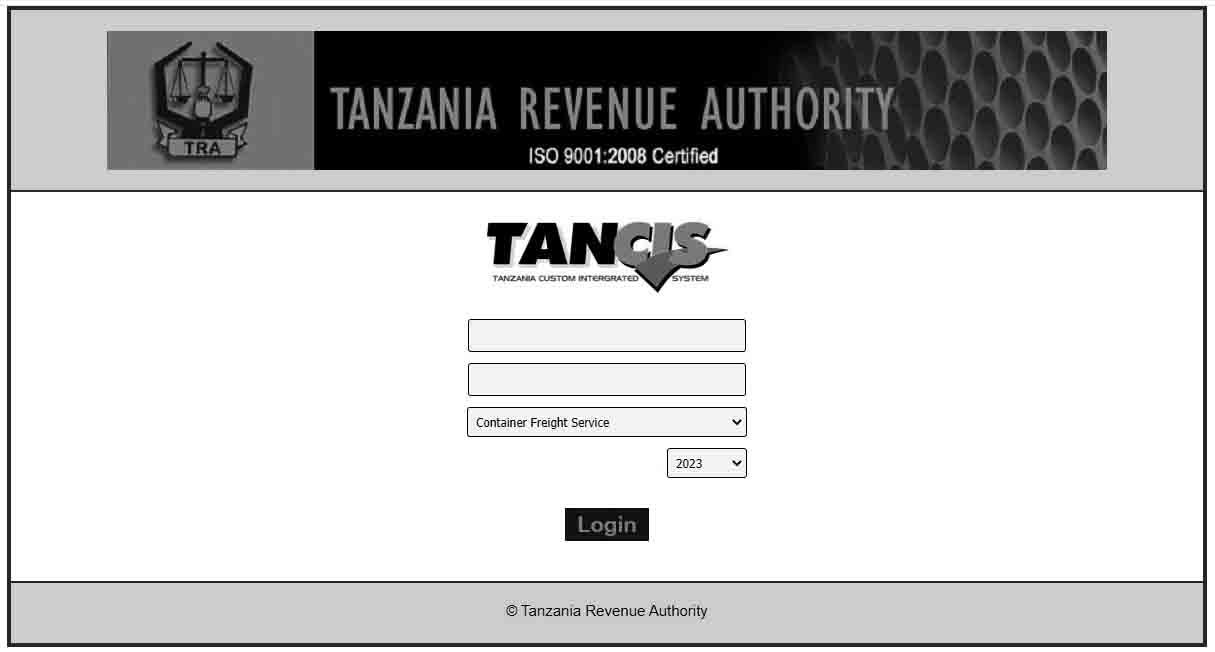

TANCIS

TANCIS stands for the Tanzania Customs Integrated Systems. This platform is created on the highest standards of technology with the aim of increasing efficiency, accuracy, transparency and confidence in Customs performance. As it is a internet platform TANCIS is gradually pushing for non-paperwork operations, strategy that has been leading to a significant reduction in the cost of doing business. TANCIS has taken a place of the old customs management systems that used to be known as ASYCUDA++ that was in use in the country since year 2005.

Link to TANCIS TRA forms – https://customs.tra.go.tz/

EFDMS (Electronic Fiscal Devices Management System) Public Portal

Electronic Fiscal Device (EFD) machines have been used in Tanzania from year 2010 for the objective of assisting the Tanzania Revenue Authority (TRA) improving revenues through better tax collection methods. At the moment, this tax system has simplified many things for traders.

Link to the TRA forms related to EFDMS – https://efdmsportal.tra.go.tz/

TRA Forms to Register Art Products

Artists can now register their art products online electronically through the TRA forms – https://gateway.tra.go.tz/FMIS/Login.aspx?ReturnUrl=%2ffmis

TRA Forms to Register Property Online

Currently these activities can be completed online:

• Generating one bill (Tax payer who is an owner of a single building)

• Generating multiple bills / master bill (Tax payer with more than one building)

• Use control numbers to obtain building payment receipts.

• View the history of all building payments via PRN

• You can register a new building, and view all your registered buildings.

• Access to verify the control number prior making payment.

Link to the TRA forms that are property related – https://prms.tra.go.tz/

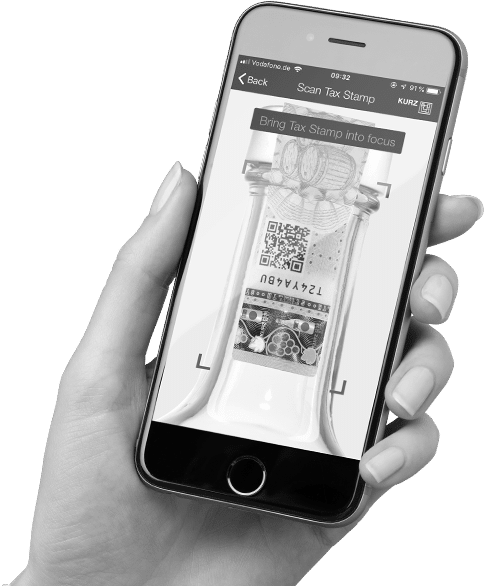

Electronic Tax Stamp Management System

The usage of Electronic Tax Stamps (ETS) for taxable goods was launches a replacement to the use of stamps made of paper that were largely associated with tax evasion and the sale of counterfeit stamps. The new system was one of Government’s initiatives aimed at improving tax performance and management across the country. Electronic Tax Stamps (ETS) is beneficial to the Government, Consumers, and Manufacturers / Importers in the following ways:

a) Protect Government Revenue by preventing the manufacture of counterfeit stamps.

b) Protecting consumers means facilitating the verification of tax stamps by telephone.

c) Develop a system of tax accountability that affects all businesses in specific areas to increase fair competition.

d) Facilitate tracking and know where the goods are from the manufacture point and at customs doors all the way to the final stage of sales.

e) Facilitate the verification of the manufacture of taxable products manufactured or imported.

Link to TRA forms relating to electronic tax stamp management system – https: //taxstamp.tra.go.tz/websso/login? Appli=sstwa

For more articles related to the Economy of Tanzania click here!